When it comes to your credit score, there are some things that can make it go down. Your credit score is like a report card for your financial behavior, and it’s important to keep it healthy. Let’s explore 10 things that can lower your credit score, explained in simple terms to help you understand better.

Jul

Your credit score is a crucial financial indicator that influences your ability to secure loans, credit cards, and other forms of credit. It reflects your creditworthiness and financial responsibility, helping lenders assess the risk of lending to you. Many people wonder whether loan rejection can impact their credit score negatively. In this blog, we

Jul

Your credit score is a critical aspect of your financial health. Whether you’re a recent graduate, a young professional, or someone who has never had credit before, building your credit score from scratch is an essential step towards achieving financial stability and unlocking opportunities for future borrowing. While it might seem intimidating at first,

Jan

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan. The borrower’s credit history is essential in these situations since the lender,

Jul

As consumers, our tendency for obtaining items on credit is at an all-time high in this credit-driven economy. Your CIBIL score or rating is based on your CIBIL report, which is a detailed summary of your credit history & record. Credit scores are not only calculated on the basis of your present actions but also on your past behaviour regarding your credit

Dec

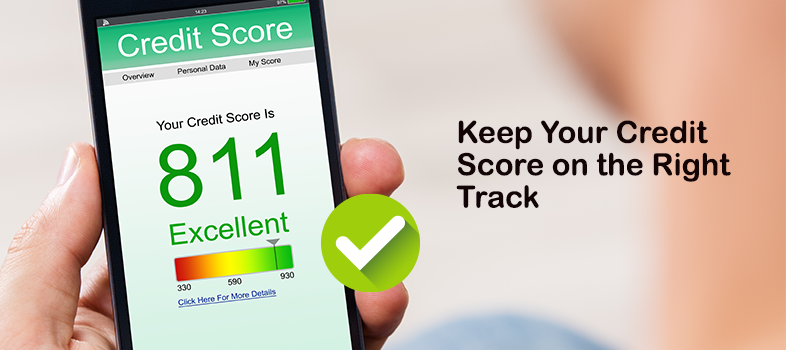

Nowadays, in and around the financial environment, every lender looks at your credit score before considering your borrower profile. On the basis of credit history, it’s much easier to assess the potential risk of losses/default. This is exactly why borrowers are looking forward to finding out their credit score & for free. However, it’s important to stay cautious & keep a few pointers in mind. Avoid being trapped

Feb

The economy has been eventually slowing down and savings are perpetually decreasing. Youngsters in India have been relying on online loan apps more. One miss in your loan repayment history can leave a blot for the next 7 years. This way, the millennials will not be able to apportion credit to urgent needs. Maybe, the

Nov

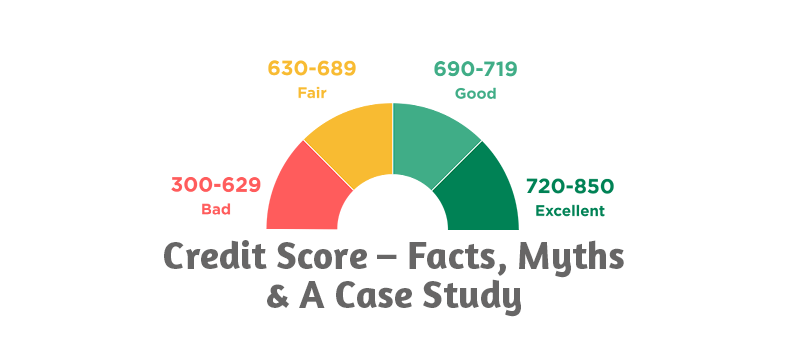

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later. Let’s switch quickly to the facts & myths now. As discussed the credit score reflects upon your qualification for a personal

Oct

The CIBIL score is built on how the credit report looks to be. This is basically a summary of your credit activity and repayment transactions. If your credit score is above 750 as a borrower, then it’s probable to have personal loans on favorable terms and conditions. However, a score below 700 can be destructive

Aug

To determine a credit score, several factors are considered as the type of employment, repayment potential, personal assets are verified before providing a loan. Practically a credit score of 650 is quite low, yet it is optimistic to take your chance. It is equally important to know that a prospective borrower will have no history

Apr

Credit utilization is defined to be the ratio of outstanding credit card balance to credit card limits. It gauges the amount of credit in use. It takes care of the amount of credit limit you are using. Let’s assume that if your balance was 3 whereas your credit limit was 10, then the credit limit

Dec

All loan or credit card payments, repayments, defaults and more reflective in your credit history of the individual, using which the credit score is arrived at. It is unavoidable to maintain a good credit score to keep your loan sanctioning process smooth and seamless. In fact, the interest rates too are determined based on the

Dec

A decent Credit Score is an immediate consequence of not one but rather a bundle of brilliant financial practices. Here are some incredibly successful lessons that can guarantee the rapid development of your Credit Score, as long as you follow them without fail. Not paying regard to even one of these lessons can severely stem

Aug

As everyone is aware, a credit score is a statistical number that represents how you have used your credit over a specific period of time. It is important to be consistent in your credit repayments to have a good credit score. A high credit score increases the probability of getting a loan easily as it