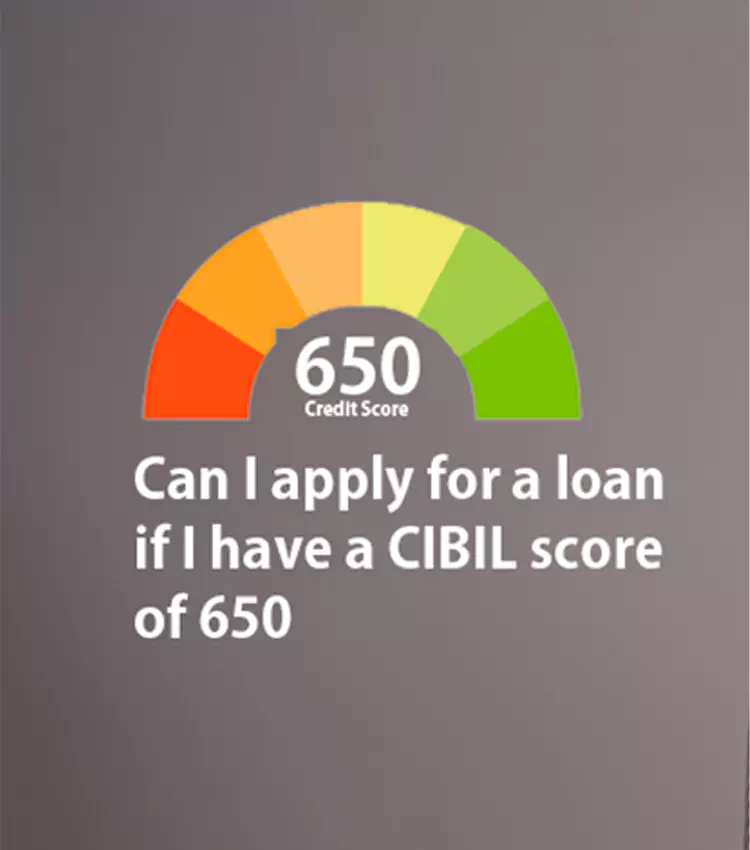

Can I apply for a loan if I have a CIBIL score of 650?

The common perception among borrowers may be that a credit score of 650 or lower can be risky for their loan instinct. And perhaps its true! It is difficult to have a loan with a credit score of 650. Prominent banks propose a higher score of 750 or more. This is primarily strategic well to avoid unexpected risks from dishonest folks. Similarly, if you want a credit card then it’s unlikely to get a credit card approved.

What are the Fallout of a Credit Score lower than 750?

As it has been mentioned previously that a score lower than 750 can greatly impact your borrowings in future. However, we must be clearly aware of the fallout when the credit score remains low at 750 or lesser. Ideally, 750 is the ideal score to qualify for an instant personal loan or credit card. So, whenever next you plan to apply for a personal loan, ensure to approach with an enhanced credit score.

A credit score lower than 750 may not give you a personal loan, but a golden chance to improve it. This is strictly bounding on banks and financial institutions to entertain disqualified applications. Banks and NBFCs have been obligated by RBI to look for a score which meets the minimum threshold to approve a loan application. If you still proceed with a score lower than 650, then you’re at own mercy. It’s better to not be hopeful about loan approval and disbursal from the large financial giants. In case, you’re considered, chances for unfavorable terms and conditions apply.

Step to take for Successful Personal Loan Application:

To begin, take the self-surveillance step! Instantly get your free credit score and a detailed credit report to understand your exemption and qualifications to apply for best personal loans.

The best credit score for the best personal loan would be above 750.

Even when your credit score is low, it is possible for you to apply for a loan. Credit score is not the only determinant for your personal loan eligibility. So, as a borrower if you meet all the eligibility criteria, then you’re good to go for a personal loan, and the score matters zilch!

Let’s talk a bit about Home Loan here as an exception to the credit score. If you’re considering a home loan, then your credit score will matter the least. Since, a home loan can be admitted as a secure loan, the credit score makes negligible difference to the lender. A collateral is duly submitted at the loan disbursal for security.

Having explained the positive and negative situations, banks attach high importance to credit score. So, it’s almost mandatory to have a high credit score that matches your eligibility criteria. We would like to recommend some tried ways to enhance your credit score for good.

- Pay off your loans, debts and liabilities.

- Pay off your running or overdue bills

- Keep balances maintained on credit cards and other revolving credit.

To sum up: your credit score reflects on your financial behavior and spending pattern. This is closely indicative of your finance handling techniques. It preempts the lending institutions to stay on top of your credit position and how well can you pay off your debts in future as well.

Also read: What is CIBIL Score and Its Importance?

संबंधित विषय

- Personal Finance

What is Personal Finance and Why is it Important?

The question of personal finance is important for all working-class people.

- Personal Finance

Top Selling Personal Finance Books to Increase Your Financial Knowledge

Today you will find a gamut of books written around personal finance as the core like money, finances, entrepreneurship, investments etc.

- Personal Finance

Can Financial Issues be managed with Personal Line of Credit

A personal line of credit can pose to be a prized facility to assist individuals in planning and executing their financial life.

- Personal Finance

Financial goals of the family: It takes two to tango.

When you meet the perfect person, it is natural to imagine how the two of you can achieve your dreams, like starting a family or sharing a home.

- Personal Finance

Does social credibility matter when taking loans?

Yes. The above-quoted question is an absolute truth.

- Personal Finance

Know it all About Personal Loans for Marriage Purpose

In the past, personal loans have been already accolated for the ease of approval and disbursal it endows upon.

- Personal Finance

To Apply or Not to Apply for an Online Personal Loan

Diwali is still a few months away. Just like many other Indian families you too have decided to renovate your house so that it is ready at least few weeks before the festival date.

- Personal Finance

Top 5 Free & Paid Financial Planning Software

In the effort to save your money, you need to keep a close eye on the earnings & expenses.

- Personal Finance

Role of Technology in Quick Verification & Instant Disbursal of “Cash Loans”

India has shown significant growth in economy in the past few years.

- Personal Finance

Important Tips To Follow When Getting Your First Personal Loan

Getting your first personal loan can be an important step in achieving your financial goals.

- Personal Finance

Financial Crisis? Mini Cash Loan is all you Need!

How are you currently tackling your financial life? What have you planned when your financial life will be amidst crisis or when an emergency knocks on your door?

- Personal Finance

Does Loan Rejection Affect Credit Score?

Your credit score is a crucial financial indicator that influences your ability to secure loans, credit cards, and other forms of credit.

- Personal Finance

Personal Loan & Education Loan - Which one to choose?

Kids these days are consumed by the brimming competition; this is one of the reasons why they want to travel abroad for higher studies.

- Personal Finance

Timelines to get a Personal Loan Sanctioned

Generally, a personal loan application process is sanctioned between 24 hours to 7 days, relying on the credibility, authenticity of information and dependability in the personal loan application.

- Personal Finance

How to know if I am Eligible for a loan?

Want a loan but worried about your eligibility? There are ways to know if you are eligible to avail a loan.

- Personal Finance

Minimum Threshold for Personal Loans

A lot of people today truly wish for expensive possessions in life.

- Personal Finance

4 Keys to Successfully Managing Personal Finances

Often the term ‘financial planning’ can be heard. But is it just having money and some bank balance?

- Personal Finance

Ease Your Personal Loan Repayment With These Golden Tips

Taking out a personal loan can be a helpful financial tool for achieving various goals, from consolidating debt to funding a major purchase.

- Personal Finance

Plan The Perfect Vacation with a Personal Loan for Travel!

Everyone deserves a break from their daily routine and to travel and explore the world.

- Personal Finance

7 Reasons Why You Should Consider a Personal Loan for Education

Education is essential in today’s world, and it’s never too late to pursue higher education or upgrade your skills.

- Personal Finance

Why Use a Personal Loan to Fund a Wedding?

Weddings are beautiful occasions that celebrate the union of two souls.

- Personal Finance

Can I Take Multiple Personal Loans at the Same Time?

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s a medical emergency, home renovation, or debt consolidation, personal loans have become a popular solution for individuals seeking quick access to funds.

- Personal Finance

Enjoy A Cheerful & Colorful Holi with Home Credit Personal Loan

Holi is a vibrant and colorful festival that brings people together to celebrate the arrival of spring.

- Personal Finance

How Can You Choose the Best Personal Loan in India?

In a country like India, where financial needs are diverse and often unexpected, personal loans have become a popular financial tool to bridge the gap.

- Personal Finance

How To Boost Your Chances of Instant Loan Approval?

Tackling your financial goals, whether they are to design your ideal kitchen or to finally pay off your credit bills, can be expensive.

- Personal Finance

How to Apply for Personal Loan for Medical Emergency?

A medical emergency might happen at any time, which means you will need money to cover your medical expenditures.

- Personal Finance

5 Creative Ways to Use a Personal Loan for Travel

Traveling is a dream that many of us share, but often, the cost can be a significant barrier.