Know it all About Personal Loans for Marriage Purpose

In the past, personal loans have been already accolated for the ease of approval and disbursal it endows upon. Marriage happens once in a lifetime, and people aspire to create magnificence. It is obvious to have expectations to make it big and end up as a memorable affair. However, it is difficult to sponsor a grand wedding without a strong financial backup.

Indian weddings have been infamous for wasteful spendings. We are imagining marriages to be larger than life. Talk about from jewelry, clothes, fancy venues, etc. However, a grand marriage is an expensive affair. To be able to afford high-cost items, it is equally important to have an extensive budget. Even if you have saved money for future events, it is not sure to be adequately done. A marriage ceremony has different brackets of expenditures like house purchase & shifting, honeymooning, daily wear clothes, chores appliances, etc. A marriage event starts the string of expenses for a long-term goal. So obviously you would not like your one-time affair to go for a toss, due to insufficiency of funds.

So, how much does an average Indian marriage cost you?

A decently organized marriage should cost somewhere ranging between 15-10 lakhs at least.

For a

large-sized budget, it is important to have advanced planning in order. Applying your long-saved deposits to organize

your marriage plans will just be foolish.

We strongly recommend you take a personal loan and straighten out your marriage plans. Typically, we tend to approach close friends and family to have financial help. This is in the expectation to avoid rejections from elsewhere.

So, why make a ‘personal loan’ decision?

It is always said that opting for a personal loan is way better than being embarrassed. A personal loan can be easily opted for a quick disbursal of your choice. Plus, it can be paid up as per the repayment schedule, decided upon at the time of sanction. Easy EMIs can sort your life in times to come.

Apply for a Home Credit Personal Loan up to five lacs to cater to everything you need!

Quick Approval & Disbursal

With a marriage planned on your agenda next, it is difficult to decide without a plan. Even when you plan effectively, there are still chances for mismanagement. Here, a personal loan can offer you instant money at a click. It offers quick approval and fast disbursal.

Flexibility

The best thing about a personal loan is its flexibility of use. The loan amount can be used for wishful thinking. Let us say, you dreamt of a designer lehnga on your marriage. A personal loan can be easily allocated to this, of course in satiating other needs too.

Eligibility to get a Home Credit Personal Loan for Marriage

The applicant must meet the following criteria:

- Be an Indian citizen aged between 18 and 60 years.

- Have valid ID proof and current address proof.

- Be employed, self-employed, or a pensioner.

- Maintain an active bank account.

- Ensure a minimum 90-day interval between two Home Credit loan applications.

- Demonstrate a monthly household income exceeding ₹25,000. “Household” refers to an individual family unit comprising a husband, wife, and their unmarried children.

- Need to be an existing customer of Home Credit (should have availed Ujjwal EMI Card/ Consumer Durable Loans/ Personal Loan/ Flexible Personal Loan in the past).

Required documents for Quick Personal Loan

To confirm identity and safety, we require certain proofs to be readily available. Under is the list of documents that are often necessary:

- PAN card of the individual

- Address proof- passport, driving license, passport, Aadhaar card, utility bills, etc.

- Bank statement of the income account with active net banking

All to know about Marriage Loans

Marriage loan has a lot of similarity with personal loans but stands true to their name as they are used for financing the marriage ceremony.

- Low EMIs therefore easy repayment

- Early loan approval, early disbursal

- Flexible duration of repayment

- Pre-payment option available

- Customized offers

- The interest rate is variable.

- Minimal extra charges

- No guarantor

संबंधित विषय

- Personal Finance

What is Personal Finance and Why is it Important?

The question of personal finance is important for all working-class people.

- Personal Finance

Top Selling Personal Finance Books to Increase Your Financial Knowledge

Today you will find a gamut of books written around personal finance as the core like money, finances, entrepreneurship, investments etc.

- Personal Finance

Can Financial Issues be managed with Personal Line of Credit

A personal line of credit can pose to be a prized facility to assist individuals in planning and executing their financial life.

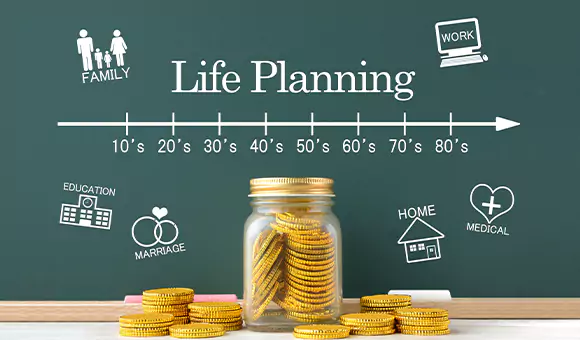

- Personal Finance

Financial goals of the family: It takes two to tango.

When you meet the perfect person, it is natural to imagine how the two of you can achieve your dreams, like starting a family or sharing a home.

- Personal Finance

Does social credibility matter when taking loans?

Yes. The above-quoted question is an absolute truth.

- Personal Finance

Can I apply for a loan if I have a CIBIL score of 650?

The common perception among borrowers may be that a credit score of 650 or lower can be risky for their loan instinct.

- Personal Finance

To Apply or Not to Apply for an Online Personal Loan

Diwali is still a few months away. Just like many other Indian families you too have decided to renovate your house so that it is ready at least few weeks before the festival date.

- Personal Finance

Top 5 Free & Paid Financial Planning Software

In the effort to save your money, you need to keep a close eye on the earnings & expenses.

- Personal Finance

Role of Technology in Quick Verification & Instant Disbursal of “Cash Loans”

India has shown significant growth in economy in the past few years.

- Personal Finance

Important Tips To Follow When Getting Your First Personal Loan

Getting your first personal loan can be an important step in achieving your financial goals.

- Personal Finance

Financial Crisis? Mini Cash Loan is all you Need!

How are you currently tackling your financial life? What have you planned when your financial life will be amidst crisis or when an emergency knocks on your door?

- Personal Finance

Does Loan Rejection Affect Credit Score?

Your credit score is a crucial financial indicator that influences your ability to secure loans, credit cards, and other forms of credit.

- Personal Finance

Personal Loan & Education Loan - Which one to choose?

Kids these days are consumed by the brimming competition; this is one of the reasons why they want to travel abroad for higher studies.

- Personal Finance

Timelines to get a Personal Loan Sanctioned

Generally, a personal loan application process is sanctioned between 24 hours to 7 days, relying on the credibility, authenticity of information and dependability in the personal loan application.

- Personal Finance

How to know if I am Eligible for a loan?

Want a loan but worried about your eligibility? There are ways to know if you are eligible to avail a loan.

- Personal Finance

Minimum Threshold for Personal Loans

A lot of people today truly wish for expensive possessions in life.

- Personal Finance

4 Keys to Successfully Managing Personal Finances

Often the term ‘financial planning’ can be heard. But is it just having money and some bank balance?

- Personal Finance

Ease Your Personal Loan Repayment With These Golden Tips

Taking out a personal loan can be a helpful financial tool for achieving various goals, from consolidating debt to funding a major purchase.

- Personal Finance

Plan The Perfect Vacation with a Personal Loan for Travel!

Everyone deserves a break from their daily routine and to travel and explore the world.

- Personal Finance

7 Reasons Why You Should Consider a Personal Loan for Education

Education is essential in today’s world, and it’s never too late to pursue higher education or upgrade your skills.

- Personal Finance

Why Use a Personal Loan to Fund a Wedding?

Weddings are beautiful occasions that celebrate the union of two souls.

- Personal Finance

Can I Take Multiple Personal Loans at the Same Time?

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s a medical emergency, home renovation, or debt consolidation, personal loans have become a popular solution for individuals seeking quick access to funds.

- Personal Finance

Enjoy A Cheerful & Colorful Holi with Home Credit Personal Loan

Holi is a vibrant and colorful festival that brings people together to celebrate the arrival of spring.

- Personal Finance

How Can You Choose the Best Personal Loan in India?

In a country like India, where financial needs are diverse and often unexpected, personal loans have become a popular financial tool to bridge the gap.

- Personal Finance

How To Boost Your Chances of Instant Loan Approval?

Tackling your financial goals, whether they are to design your ideal kitchen or to finally pay off your credit bills, can be expensive.

- Personal Finance

How to Apply for Personal Loan for Medical Emergency?

A medical emergency might happen at any time, which means you will need money to cover your medical expenditures.

- Personal Finance

5 Creative Ways to Use a Personal Loan for Travel

Traveling is a dream that many of us share, but often, the cost can be a significant barrier.