Significance of Aadhaar in ID Verification of Personal Loan

A few years ago, more than half a billion people in India had no official ID of any kind which made it impossible for them to receive government aids, open a bank account, avail a loan, get a driving license, and so on. Also for availing services like personal loans, or opening a bank account required a number of documents like address proof, birth proof, identity proof, etc. which would often lead to confusion due to discrepancies and delays in approvals.

Indian Government launched Aadhaar Card, in April 2010 with an aim to provide a foundation for better access to services for a large segment of the population and since then it has massively changed the way government services were delivered. Today, it is being used not just as a proof of identification of citizenship but to avail various services like opening a bank account, availing personal loans, getting a new sim card or a PAN card, filing income tax returns, etc. According to a report published in a leading daily, more than 111 crores out of a population of 125 crores + today have Aadhaar card. This makes it the biggest biometric database on Earth.

How it all began:

Aadhaar card is a 12-digit unique identification number given

to all the

citizens by the government of India by collecting their fingerprints and iris scans. The government launched the

Aadhaar card with the following objectives:

- To give universal identity to every Indian citizen

- To introduce a versatile card that can be used as an identity proof, address proof and age proof so that Indians do not have to carry multiple documents when applying for any government service.

- To help the citizens avail various government subsidies eliminating the need for intermediaries.

Read more interesting benefits of Aadhaar here: Benefits of Your Aadhaar Card

Aadhaar Card for financial inclusion:

For years, India’s financial strategy tried to expand access by opening more bank branches, but this resulted in high operating costs for low-value services driven by paper-based verifications. Aadhaar overcame these costs using technology through e-KYC for users. This has helped in the financial inclusion and providing easy access to loans. Increasing access to financial services can lead to increased economic prospects for individuals and communities.

Impact of Aadhaar on private sectors

While the Indian government has made it mandatory for all Indian citizens to have an Aadhaar card to

avail government

services, even the private sectors have started relying on it to verify candidates while hiring them, for opening a

bank account and for other services. Also, online finance providers are asking consumers to get the KYC linked with

their Aadhaar card to avail of an

instant cash loan.

With the rise of Digital India, people have started relying on online finance

providers for availing hassle-free and quick cash loans. But a few years ago, availing loans was quite laborious

since it required carrying a number of documents to the banks, standing in long queues, and waiting for weeks from

the bank to hear for approval. This was mainly because the verification process used to take days and sometimes even

weeks.

Today, digitization and Aadhaar Card has revolutionized the loan approval and disbursal process. With

the help of technology, online finance providers have recently launched paperless electronic-KYC

(e-KYC)

where the customers don’t have to submit physical documents for loan approval. It links your Aadhaar card with

your KYC to authenticate your identity through one ID only. This has made the verification process extremely easy

and quick and has led to instant disbursal of cash loan.

Security concerns with Aadhaar Card: -

Today, the Aadhaar database is one of the largest government databases in the world which contains both demographic and biometric data of the citizens and this is exactly why it has always been under the radar for security shortcomings. In the last year, there has been a lot of instances where the Aadhaar data was leaked through government websites. Apart from this, there were reports of gangs generating fake and duplicate Aadhaar cards and selling the Aadhaar card details to service providers.

The launch of Virtual IDs to protect privacy: -

To address these security concerns, UIDAI introduced a new concept of Virtual ID, a 16-digit random number mapped to Aadhar number, which can be generated by the Aadhaar card holder from the UIDAI website. It enables users to not share their twelve digits unique identification number for authentication purposes. Virtual ID gives limited details like name, address, and photograph, which are enough for any verification.

Read More: 5 Easy Steps to do Online KYC for your Home Credit Loan

How secure is Virtual ID? How is it different from Aadhaar?

Virtual IDs give an extra layer of security to your Aadhaar biometric and demographic details. This

ensures that the

agencies do not have access to your Aadhaar number thus reducing the chances of financial frauds or profiling.

Companies, while authenticating your verification, are only shown your virtual ID and receive a UID token that

confirms it is mapped to your Aadhaar number. Also, one cannot derive the Aadhaar number from the Virtual ID. It is

temporary and revocable which means even if an agency stores your virtual ID to profile you, it will not matter

since it is not permanent and can be changed. A user can generate as many Virtual IDs as he or she wants. Once a

fresh Virtual ID is generated, the older one gets canceled.

संबंधित विषय

- Personal Finance

What is Personal Finance and Why is it Important?

The question of personal finance is important for all working-class people.

- Personal Finance

Top Selling Personal Finance Books to Increase Your Financial Knowledge

Today you will find a gamut of books written around personal finance as the core like money, finances, entrepreneurship, investments etc.

- Personal Finance

Can Financial Issues be managed with Personal Line of Credit

A personal line of credit can pose to be a prized facility to assist individuals in planning and executing their financial life.

- Personal Finance

Financial goals of the family: It takes two to tango.

When you meet the perfect person, it is natural to imagine how the two of you can achieve your dreams, like starting a family or sharing a home.

- Personal Finance

Does social credibility matter when taking loans?

Yes. The above-quoted question is an absolute truth.

- Personal Finance

Best Financial Tips to the Younger Self

We keep reading articles that money has the power to transform life remarkably, be it earned or acquired.

- Personal Finance

Know it all About Personal Loans for Marriage Purpose

In the past, personal loans have been already accolated for the ease of approval and disbursal it endows upon.

- Personal Finance

Can I apply for a loan if I have a CIBIL score of 650?

The common perception among borrowers may be that a credit score of 650 or lower can be risky for their loan instinct.

- Personal Finance

To Apply or Not to Apply for an Online Personal Loan

Diwali is still a few months away. Just like many other Indian families you too have decided to renovate your house so that it is ready at least few weeks before the festival date.

- Personal Finance

Top 5 Free & Paid Financial Planning Software

In the effort to save your money, you need to keep a close eye on the earnings & expenses.

- Personal Finance

Why Do Instant Short-Term Cash Loan Matter a Lot?

When it comes to eradicating your immediate financial needs, the option of instant short-term loans do help.

- Personal Finance

Role of Technology in Quick Verification & Instant Disbursal of “Cash Loans”

India has shown significant growth in economy in the past few years.

- Personal Finance

Youngsters are taking Special Interest in Credit Scores

The economy has been eventually slowing down and savings are perpetually decreasing.

- Personal Finance

Important Tips To Follow When Getting Your First Personal Loan

Getting your first personal loan can be an important step in achieving your financial goals.

- Personal Finance

Financial Crisis? Mini Cash Loan is all you Need!

How are you currently tackling your financial life? What have you planned when your financial life will be amidst crisis or when an emergency knocks on your door?

- Personal Finance

Does Loan Rejection Affect Credit Score?

Your credit score is a crucial financial indicator that influences your ability to secure loans, credit cards, and other forms of credit.

- Personal Finance

Personal Loan & Education Loan - Which one to choose?

Kids these days are consumed by the brimming competition; this is one of the reasons why they want to travel abroad for higher studies.

- Personal Finance

Timelines to get a Personal Loan Sanctioned

Generally, a personal loan application process is sanctioned between 24 hours to 7 days, relying on the credibility, authenticity of information and dependability in the personal loan application.

- Personal Finance

How to know if I am Eligible for a loan?

Want a loan but worried about your eligibility? There are ways to know if you are eligible to avail a loan.

- Personal Finance

Minimum Threshold for Personal Loans

A lot of people today truly wish for expensive possessions in life.

- Personal Finance

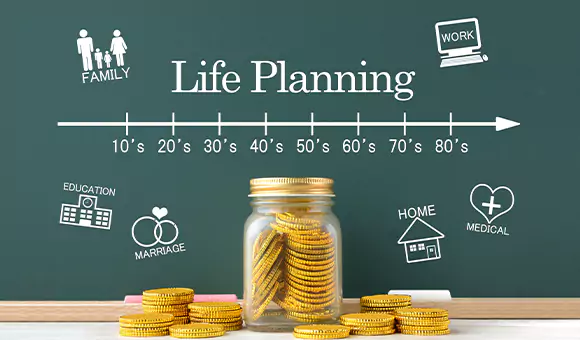

4 Keys to Successfully Managing Personal Finances

Often the term ‘financial planning’ can be heard. But is it just having money and some bank balance?

- Personal Finance

Ease Your Personal Loan Repayment With These Golden Tips

Taking out a personal loan can be a helpful financial tool for achieving various goals, from consolidating debt to funding a major purchase.

- Personal Finance

Plan The Perfect Vacation with a Personal Loan for Travel!

Everyone deserves a break from their daily routine and to travel and explore the world.

- Personal Finance

7 Reasons Why You Should Consider a Personal Loan for Education

Education is essential in today’s world, and it’s never too late to pursue higher education or upgrade your skills.

- Personal Finance

Why Use a Personal Loan to Fund a Wedding?

Weddings are beautiful occasions that celebrate the union of two souls.

- Personal Finance

Can I Take Multiple Personal Loans at the Same Time?

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s a medical emergency, home renovation, or debt consolidation, personal loans have become a popular solution for individuals seeking quick access to funds.

- Personal Finance

Enjoy A Cheerful & Colorful Holi with Home Credit Personal Loan

Holi is a vibrant and colorful festival that brings people together to celebrate the arrival of spring.

- Personal Finance

How Can You Choose the Best Personal Loan in India?

In a country like India, where financial needs are diverse and often unexpected, personal loans have become a popular financial tool to bridge the gap.

- Personal Finance

How To Boost Your Chances of Instant Loan Approval?

Tackling your financial goals, whether they are to design your ideal kitchen or to finally pay off your credit bills, can be expensive.

- Personal Finance

How to Apply for Personal Loan for Medical Emergency?

A medical emergency might happen at any time, which means you will need money to cover your medical expenditures.

- Personal Finance

5 Creative Ways to Use a Personal Loan for Travel

Traveling is a dream that many of us share, but often, the cost can be a significant barrier.

- Personal Finance

25 “Must Have” Personal Financial Habits

Are you handling your finances well? Or do you need further improvements? In this article, we are talking about the 25 best practices to maintain good financial management.

- Personal Finance

5 Reasons to apply Personal Loan from Home Credit

From time to time, we always have crucial decisions to make, and chances are that it will cost money!