What is FOIR? Fixed Obligation to Income Ratio Explained for Loan Approval

FOIR (Fixed Obligation to Income Ratio) calculates the percentage of your monthly net income that is already committed to fixed expenses like existing EMIs, rent, and credit card bills. A lower percentage indicates high disposable income and creditworthiness, while a high percentage signals financial stress. Understanding the FOIR calculation and formula is essential for anyone planning to take a home loan, personal loan, or car loan. This blog covers the FOIR full form, how to calculate it, ideal ranges, and actionable tips to improve your ratio for instant loan approval.

What is FOIR? Meaning, Full Form, Formula & Its Impact on Loan Eligibility

In the world of personal finance, most borrowers operate under a common misconception: "If my credit score is 750+, my loan is guaranteed."

While a healthy credit score is indeed a gatekeeper, it is not the only key to the vault. You might have an impeccable repayment history, but if your current income is already stretched thin by existing debts, a bank will hesitate to lend you more money. To measure this specific risk, financial institutions rely on a critical metric.

If you have ever wondered why a loan application was rejected despite a good credit score, the answer likely lies in understanding ‘what is FOIR?’.

FOIR Full Form: What is Fixed Obligation to Income Ratio?

Let’s start by stripping away the banking jargon. The FOIR full form stands for Fixed Obligation to Income Ratio.

In some global markets, you might hear terms like "Debt-to-Income Ratio" (DTI), which is very similar. However, the FOIR full form in finance specifically points to a more comprehensive calculation used by Indian and Asian banks. It doesn't just look at your debts; it looks at all your "fixed obligations."

What is the Core Concept of FOIR?

The concept is simple: Banks want to know how much "breathing room" you have in your salary.

When you receive your paycheck at the end of the month, a portion of it immediately disappears into non-negotiable payments—rent, car payments, student loans, or credit card bills. These are your fixed obligations. FOIR is simply the percentage of your income that is eaten up by these fixed costs before you even buy groceries or pay for electricity.

If your income is a pie, FOIR tells the bank how many slices are already gone before they ask for their share.

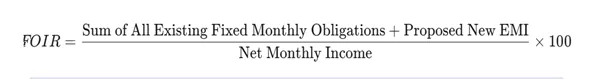

FOIR Formula: How to Calculate Your Ratio

You do not need a financial advisor to determine where you stand. The FOIR formula is straightforward logic converted into a mathematical percentage.

Breaking Down the Variables

To ensure your FOIR calculation is accurate, you need to know exactly what figures to plug into the formula.

- Net Monthly Income: This is crucial. Banks do not look at your "CTC" (Cost to Company) or Gross Salary. They look at the Net Take-Home Pay—the amount that hits your bank account after taxes, provident fund (PF), and professional tax deductions.

- Existing Fixed Obligations: This includes:

- All current Loan EMIs (Personal, Auto, Education, etc.).

- Credit Card minimum due amounts (usually calculated at 5% of the outstanding balance).

- Residential Rent (most banks consider this a fixed obligation even if you don't have a formal loan for it).

- Proposed New EMI: The estimated monthly installment of the loan you are currently applying for.

Note: Variable expenses like food, utility bills, entertainment, and fuel are generally excluded from the FOIR formula because these can be adjusted (tightened) by the borrower in times of crisis, whereas EMIs cannot.

What is an Ideal FOIR Level?

Now that you understand what is FOIR, the next logical question is: What is the magic number? While policies vary from bank to bank, the general benchmarks in the industry are as follows:

|

FOIR Range |

Risk Level |

Loan Probability |

|---|---|---|

|

Below 40% |

Low Risk |

Excellent. You are an ideal candidate. Banks will likely offer you the best interest rates and full loan amounts. |

|

40% to 50% |

Moderate Risk |

Good. This is the standard threshold for most salaried employees. You will likely get approval, perhaps with minor conditions. |

|

50% to 60% |

High Risk |

Difficult. Approval is tough. The bank may ask for a co-applicant, a longer tenure, or a higher interest rate to offset the risk. |

|

Above 60% |

Critical |

Rejection Likely. Most banks will decline the application as the risk of default is too high. |

There are exceptions. For very high-net-worth individuals (HNIs) with massive incomes, banks might accept a FOIR of up to 60-65%, assuming the remaining 35% of their income is still a substantial amount of money for living expenses.

The Impact of FOIR on Your Loan

Your FOIR score doesn't just dictate a "Yes" or "No" on your application; it nuances the terms of the deal. Let us look at some examples, these may vary from situation to situation but can help give you an understanding.

- Loan Sanction Amount

This is the most direct impact. If your FOIR calculation shows you are at 45%, and taking a large loan would push you to 60%, the bank will simply reduce the loan amount. Instead of the INR 2,50,000 you asked for, they might offer INR 1,50,000 to keep your ratio within the safe zone.

- Interest Rates

Lenders practice "Risk-Based Pricing." A borrower with a low FOIR (high disposable income) is a safe bet and may qualify for preferential, lower interest rates. A borrower pushing the limit of 50% might be charged a "risk premium," resulting in a higher interest rate.

- Tenure Requirements

To make the FOIR formula work in your favor, a bank might suggest increasing the loan tenure. By stretching a loan from 10 years to 20 years, the monthly EMI drops. This lowers the FOIR, potentially moving you from the "Red Zone" to the "Green Zone," even if the total interest paid overtime increases.

How to Improve Your FOIR Before Applying

If you have run the numbers and realized your FOIR is too high, do not lose hope. It is not a permanent record like a credit default. It is a snapshot of your current financial health. You can change the picture with these strategies:

- The "Snowball" Method for Existing Debt

Before applying for a big loan (like a mortgage), try to close out smaller short-term loans. Foreclosing a car loan or paying off a consumer durable loan eliminates that monthly EMI from the FOIR calculation, instantly dropping your ratio.

- Add a Co-Applicant

This is the most effective hack. If you apply with a working spouse or parent, the bank considers your combined net income.

- Your Income: INR 60,000

- Spouse Income: INR 50,000

- Total Income: INR 1,10,000

Even if your obligations remain the same, the denominator in the formula doubles, cutting your FOIR significantly.

- Declare Additional Income

Do you have rental income? A freelance side hustle? A yearly performance bonus? Ensure this is documented and presented to the lender. Increasing the "Income" side of the equation is just as effective as reducing the "Obligation" side.

- Clear Credit Card Dues

Many people don't realize that carrying a high balance on credit cards affects loan eligibility. Even if you pay on time, the "Minimum Amount Due" is factored into your obligations. Clearing these balances to zero removes this line item from the calculation.

Conclusion

While the FOIR full form might sound like dry financial terminology, it is essentially a mirror of your financial lifestyle. It answers the fundamental question: Are you living within your means?

Lenders use FOIR to protect themselves, but you should use it to protect yourself. A ratio under 40-50% ensures that you aren't just working to pay EMIs but have enough liquidity to enjoy life and handle emergencies. Before you sign your next loan application, take five minutes to run the numbers—it’s the smartest financial move you can make.

Ready to apply for a loan? Calculate your FOIR first to boost your chances of approval.

This content is for educational/informational purposes only. The opinions shared in this blog should not be considered professional advice. Readers are encouraged to do their own research and seek independent financial guidance.

Related Topics

- Borrowing

Should you Borrow Money from your Friends and Family?

There were times, when we depended upon our friends and family for urgent financial assistance.

- Borrowing

Alternatives to a Personal Loan

For urgent unexpected expenses, we usually turn to the easiest solution available around us, Personal Loans.

- Borrowing

What happens when you default on loan payments?

If you default on a personal loan, you may have to go through serious repercussions which could also include impaired CIBIL score.

- Borrowing

How to link PAN with Aadhaar Card Online?

The Government of India through its last budget announced how significant it is for every individual to link their PAN with Aadhaar.

- Borrowing

Short Term Loans: Your Best Source for A Budding Business

A short-term loan is organized to be paid back within a year.

- Borrowing

Challenges of Taking an Education Loan in India

Education loan sounds an easy option and also respite in the times of difficult but comes along a lot many challenges that drain your energy to an extent that you find such loans as a burden offering you sleepless nights and poor credit history in case you miss to repay them on time.

- Borrowing

Role of Digital Lending in the Evolution of Consumer Spending Behavior

In the past few years, India has witnessed a drastic change in consumer aspirations and spending behaviors.

- Borrowing

How Can a Non-Salaried Person Get a Loan?

Getting a loan for an individual with regular employment or business is an elongated process and any applicant has to go through it.

- Borrowing

Sharing a Mutual Support System -Digital Lending & Indian Economy are Growing Faster than Ever

As per a recent report shared by World Bank, India is all set to regain its position as the world’s fastest growing major economy as “factors holding back growth in India fade.”

- Borrowing

How can a Therapist Apply for Education Loan to Double Their Income?

Are you an aspiring therapist? We are sure that you are no stranger to hard work already.

- Borrowing

Online Education Loans – Funds for Higher Education in Bangalore

Higher education in India or abroad is a transformative decision which takes a long time.

- Borrowing

Small Cash Loan for a New Startup

Startups need just as much manual work to be done as mental mappings and thinking ideation.

- Borrowing

Best Online Cash Loan Providers in India

Typical bank setups take long to validate applications and the small lenders charge rate of interest, processing fees, and other terms and conditions.

- Borrowing

Reasons why Millennial Women take More Loans than Men

Of course, we know that women today do not like to be financially dependent.

- Borrowing

Understanding the Dynamics of Instant Travel Loans in Chennai

In a fast-moving city like Chennai, it is imperative to have an instant travel loan at an arms distance.

- Borrowing

Top 5 Safe Banking Tips You Should Know

Kudos to the digitization today that banking is now easy & fast!

- Borrowing

What is the Eligibility Criteria for Small Business Loans in Chennai?

Getting a loan for a small business loan in Chennai can be made easy through Home Credit. We provide personal loans that can support a new business venture.

- Borrowing

Using Short-Term Loan to Close Other Loans

The reasons for preferring a personal loan are already discussed at length, however, they can be suited better in a specific situation more.

- Borrowing

Get Lucrative Accounting Career with Home Credit Education Loan

Are you thinking to start an accounting career? Based on your aspirations, it is important to take a decision on the certifications & degrees.

- Borrowing

Best Small Business Loans in Kolkata

Kolkata has reached a commercially viable status in an extremely short span of time.

- Borrowing

Business Loans for Startups- opt Now!

Business loans needed by startups are majorly aimed at their sustainability in the longer run.

- Borrowing

Can a Person get a Business loan for Starting a Blog Website?

Under the most general cases, lending institutions provide specific personal loans for working capital, property purchases, financing home improvements, inventory stock,

- Borrowing

Do Short Term motives influence a Cash Loan Decision?

Let’s get this straight and right. The answer to this question is YES. Short term motives very definitely influence a Cash Loan decision.

- Borrowing

Why is Calculating APR Crucial Before Taking a Loan?

Taking out a loan is a significant financial decision that can have long-lasting consequences on your financial health.

- Borrowing

Here’s Why you Need to go for a Personal Loan

Wondering how to solve your financial mistakes?

- Borrowing

How to apply for a loan under startup India?

Let us first know about Start up India scheme.

- Borrowing

Can A Home Improvement Loan Be Combined With A Home Loan?

Typically, you opt for a home loan to buy a property or build a house on it.

- Borrowing

Mini Cash Loan- Quick Finance for Your Needs

With the growing digital economy, Fintech companies in India are making lending extremely easy for both the lenders and the borrowers.

- Borrowing

Can you get immediate loans in India?

With the level of digitalization is taking the lending scene one notch higher!

- Borrowing

Can you get Home Renovation Loans for a Mortgaged Property?

As we already understand, a home renovation loan is considered to make beauty changes to your existing property.

- Borrowing

Where to get a quick and easy instant loan online?

Easy and fast instant personal loans are important to fulfill your urgent financial requirements.

- Borrowing

Smartest Ways to Finance a New Business Set up

Every new business setup requires funds to embark on a journey of hard work, financial backup, solid product ideas, adequate stock, and a team of competent professionals.

- Borrowing

Equipment Loans for Business Expansion

Every business when gets started needs an initial push, this is similar to a solid business expansion.

- Borrowing

Can I Get A Personal Loan Online Without Branch Visit?

In today’s fast-paced world, convenience and accessibility have become paramount, and the financial industry is no exception.

- Borrowing

Want to Manage Big Spends? Opt for Instant Personal Loans!

In today’s fast-paced world, financial needs can arise unexpectedly, and sometimes our savings may not be enough to cover significant expenses.

- Borrowing

Advantages of Borrowing Personal Loans from a Loan App

In today’s fast-paced world, financial needs can arise unexpectedly, and having access to quick and easy lending options is essential.

- Borrowing

How to Fund a Last-Minute Vacation Without Credit Cards?

The sun is shining, the days are longer, and that unmistakable summer vibe is in the air.

- Borrowing

Looking for a Small Business Loan? Here’s How You Can Get It!

Are you looking for a small business loan? You’ve likely heard of Home Credit and are now ready to take that big step of applying for it.

- Borrowing

How Much Personal Loan Can I Avail with a 25000 Salary?

In today’s fast-paced world, personal loans have become a popular choice for meeting various financial needs.

- Borrowing

How to get an Instant Personal Loan for Home Renovation?

Buying your dream house and keeping up with its regular maintenance can be expensive.

- Borrowing

5 Instances When You May Need Personal Loans For Your Business

As a small business owner, you are no stranger to the constant need for financial resources to fuel growth and navigate through unexpected challenges.

- Borrowing

5 Tips to get an Easy Medical Loan in Hyderabad

How do you imagine a natural emergency to look like when it falls upon you? This could call for adequate financial security to cover for urgent requirements even in a city like Hyderabad.

- Borrowing

5 Common Hurdles of Individuals when Taking Loans

Applying for a loan is an easy ‘to do’. But, how many times does that application actually gets approved? Not always.

- Borrowing

3 Ways to Get Fast Approval on Your Next Cash Loan

When you find yourself in need of a quick cash loan, then waiting for approval can be frustrating.

- Borrowing

“Instant” cash loan safeguarding from contingent financial crisis

Belonging to an Indian middle-class family all through my life, I have been very careful about managing my expenses in proportion of my earnings.