How to apply for a Cash loan Online?

Getting cash loans have become easy nowadays. With technologies getting advanced, processes getting simpler and faster and minimal documentation requirement, cash loans are a few clicks away. You don’t have to stand in long queues of the bank and go through a tedious process of loan application because now you can get cash loans online with instant approvals and disbursal within a day.

How to apply for a Cash loan Online?

There are several banks as well as NBFCs offering cash loans online. Visit the bank website or download the application and fill in the application to get cash loans instantly.

Here are some usual steps of applying for a loan online.

- Visit the website or download the application.

- Log in with your credentials

- Upload documents

- Select the loan duration and amount.

- Wait for the approval

- Your loan application is complete

In case you get instant approval, and your background verification is successful, the loan amount gets disbursed within a day.

Home Credit is one such NBFC that offers instant loan online. Download its application, log in with required information, choose your loan amount and duration, upload documents and wait for the approval. Once you receive the approval, visit our POS for document verification and your loan gets disbursed in no time.

All you need for Home Credit Personal loans

- Download Home Credit Personal Loan App

- PAN card and one ID proof

- Mobile number linked with Aadhar

- Net banking facility on your bank account

With these minimal requirements you can get personal loans within few hours. Apply now

What is the need of Cash loans?

Emergency knocks your door anytime, anywhere. Most emergency situations need immediate cash. Be it medical emergency, family requirements, personal needs, etc. All you need is liquid cash or sufficient balance in your bank accounts. Cash loans are the respite to such problems and easy solutions to cash crises.

Also Read: Document Required to apply for a Personal Loan Online

Why to apply for a Cash loan Online?

With technology driven world, we too need to match the pace and adapt to the new changes that will help develop a country as a whole. That is where we place online loans that are fast, simple and easy. Here are certain reasons why applying loans online are better.

- The online loan application is fast and easy with clear loan applications steps and policies right in front. Except the background verification, you can access everything about your application. Once you have an active loan, the loan summary, pending EMIs, EMI date etc., everything is available and accessible easily.

- The online loan application process is transparent and doesn’t require recurring follow ups.

- The online loan application is paperless and reduces piles of paper collection and other formalities.

- The online loan application is independent of bank officials and documentation dependency.

- The process is fast and easy.

With this ease of loan application online, I am sure you would give it a try once and would like to experience the simplicity of the process. To get instant cash loans online, apply now.

Related Topics

- Financial Literacy

4 Easy Ways to Know Your PF Account Number & Balance

Members of the EPFO program now have relatively easy access to the EPF facility thanks to the Employees’ Provident Fund Organization (EPFO).

- Financial Literacy

Rebuild Your Credit with These 5 Simple Ways

It might be more difficult to rebuild your credit than it is to start from scratch.

- Financial Literacy

Personal Loan Vs Line of Credit, What is the Best Option

Every line of credit exhibits different characteristics compared to a regular loan.

- Financial Literacy

Kill Your Financial Demons this Dussehra

India is the land of cultural diversities and celebrations.

- Financial Literacy

6 Major Pros and Cons of Refinancing Student Loans

Whenever you’re wishing to lower your interest rates & save some money, it’s favorable to use student loan refinancing. Though, refinancing is not the best option to choose from.

- Financial Literacy

How to Make Money Even While Sleeping?

How would it be to have money credited to your bank account even while you’re sleeping at night?

- Financial Literacy

How to Apply for a Home Loan in India- A Full Overview

Home loan or housing loan is a certain amount of money borrowed by an individual to purchase a house or any piece of residential property for a specific time period.

- Financial Literacy

How to prioritize Your Various Personal Financial Goals?

Ideating & building on financial goals is an important yet creative job for individuals, if not for all.

- Financial Literacy

How to Apply for Easy loan on Existing Business in India?

Just as difficult as it sounds a loan can be sanctioned by a bank, NBFC or an online P2P lending platform. P2P lending platforms are basically NBFCs as watched by RBI and the statutory bodies.

- Financial Literacy

Why is it Important to Have Additional Sources of Income?

Having additional sources of income is a necessity these days, and must be always worked for.

- Financial Literacy

Which are the most Featured Type of Credit Cards?

The gaining popularity of credit cards is quite evident & can be seen denting an impact on the lending & borrowing space.

- Financial Literacy

Smart Ways to Improve your Credit Score

As everyone is aware, a credit score is a statistical number that represents how you have used your credit over a specific period of time.

- Financial Literacy

Top 10 Important Financial Moves to Make Before Hitting 30

We all want to grow rich. We work round the clock, push our limits to work over-time, and shift jobs which offer a good pay.

- Financial Literacy

Credit Utilization Ratio: How Does it affect your Credit Position?

Credit utilization is defined to be the ratio of outstanding credit card balance to credit card limits.

- Financial Literacy

How is Credit Score Relevant to You?

All loan or credit card payments, repayments, defaults and more reflective in your credit history of the individual, using which the credit score is arrived at.

- Financial Literacy

How to Apply for a Home Loan in India

Home loan or housing loan is a certain amount of money borrowed by an individual to purchase a house or any piece of residential property for a specific time period.

- Financial Literacy

How to apply instant personal loan from Home Credit?

Home Credit is a leading personal loan provider in the fastest moving financial market.

- Financial Literacy

How is Home Credit a better option for Home Improvement Loan?

From the beginning of our career, we channelize our efforts to build an owned house.

- Financial Literacy

7 Tips to Manage your Finances Better

It is 1st of the month, and you get a message on your phone saying that some amount has been credited to your bank account.

- Financial Literacy

Everything you want to know about a Credit Score

To determine a credit score, several factors are considered as the type of employment, repayment potential, personal assets are verified before providing a loan.

- Financial Literacy

Tips for the first time ‘Cash Loan’ takers

Every first experience you have leaves you thrilled.

- Financial Literacy

How to Improve Your CIBIL Score and Why It Matters

We know that there are parameters to check the health status of an entity.

- Financial Literacy

How to get home equity loan with bad credit?

When you build a new house, you hope to build lifetime memories in it.

- Financial Literacy

How to break the Credit Cards addiction?

Are you carrying multiple credit cards in your wallet?

- Financial Literacy

How to Apply for Short Term Loan in India?

Majorly, personal loans are long-term and have high interest rates on the lent amount.

- Financial Literacy

Distinguish between business loan and micro loan.

The difference between a business loan and micro loan lies in the scope of the two.

- Financial Literacy

Quick Steps to Link your Mobile Number with Aadhaar-The New “Trust” Factor

About 1.2 billion people have an Aadhaar number today which is about a whopping 99% of the adult population of our country.

- Financial Literacy

6 Things that Show on Your Credit Report

There is no surprise to reveal that a credit report reflects on your past credit transactions.

- Financial Literacy

7 Things You Must Do for Successful Verification & Get Instant Cash Loan Approval

A few years ago, the lending process in India was cumbersome where

- Financial Literacy

How to Get a Higher Credit Limit Easy?

Let us start with the main question whether you want to increase the credit limit or not.

- Financial Literacy

What is the Perfect Credit Score for a Small Business Loan?

To begin, small businesses typically base their operations on the investment received from reliable sources.

- Financial Literacy

Checklist for a Small Business Loan Application

Taking a small business loan from a reputed lender may increase your chances of quick loan approval.

- Financial Literacy

The System of Aadhaar Based Virtual ID

Unique Identification authority of India (UIDAI) has launched Aadhaar Virtual ID also known as VID, a temporary ID to be used at all places.

- Financial Literacy

Important Customer Advisory: Protect Yourself from Financial Frauds

At Home Credit, your financial safety and security are our highest priorities.

- Financial Literacy

Reasons Why You Should Approach an Online Lender for Loans

We all need to borrow money at some point in our lives to fulfill our goals and desires.

- Financial Literacy

Financial Lessons to be learnt this Diwali

Diwali, the festival of lights offers interesting financial lessons which can be used for future planning.

- Financial Literacy

How Payments Banks are different from Regular Banks

Payment banks are primarily based on the new business model proposed by the Reserve Bank of India.

- Financial Literacy

How do Credit Cards Work and What to Know?

A credit card is a convenient mode of payment made of plastic that allows you to make purchases online/ offline without parting cash.

- Financial Literacy

Safeguard Your Financial Journey with Home Credit Safe Pay

In a world that’s constantly evolving, financial security has taken on a new level of importance.

- Financial Literacy

Ways Women Can Manage Their Finances Independently

In our patriarchal society, women have been put down for decades

- Financial Literacy

Can’t find a guarantor for a loan? Here’s what your option

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours.

- Financial Literacy

Aadhaar Virtual ID – How Safe is it?

You will now be using your Aadhaar virtual ID or VID similarly as you utilize your Aadhaar card details when it comes to banking operations, telecom organizations and so on.

- Financial Literacy

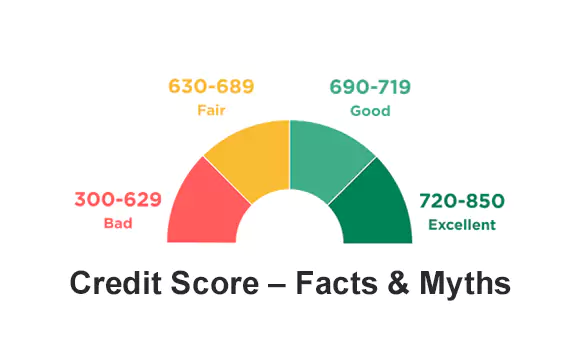

Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later.

- Financial Literacy

Reasons Why Instant Loans Help You Overcome Emergency Situations

Life is unpredictable; you never know what it may have in store for you.

- Financial Literacy

Why Are There Different Types Of Credit Scores?

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan.

- Financial Literacy

Aadhaar Virtual ID And its Benefits

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID.

- Financial Literacy

Virtual ID in the Real World

Have you heard about Virtual ID? UIDAI introduced Virtual IDs after facing concerns over security of users’ data.

- Financial Literacy

Tired of Unwanted Calls? Reclaim Your Peace with TRAI DND!

In today’s digital age, our phones are irreplaceable, but they also bring tons of unwanted calls and messages.

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

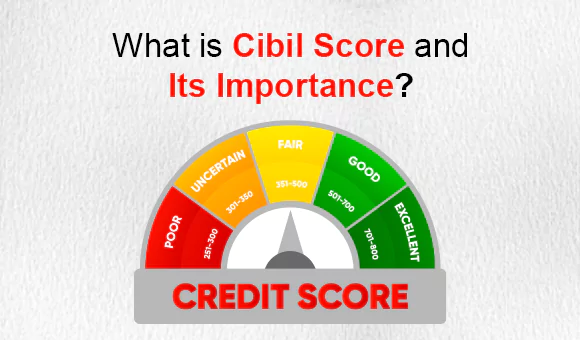

What is CIBIL Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

Understanding Personal Loan Interest Rates and Calculations

Personal loans can be a great way to manage big expenses or emergencies, but do you know how their interest is calculated? It’s not as tricky as it seems!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.