Important Customer Advisory: Protect Yourself from Financial Frauds

At Home Credit, your financial safety and security are our highest priorities. We want to ensure you have all the information needed to protect yourself from potentially fraudulent activities that could misuse our company name and reputation.

In today's digital landscape, it's crucial to understand how fraudsters might attempt to deceive customers by impersonating legitimate financial institutions. Being aware of these tactics helps you stay one step ahead and protects your hard-earned money from falling into the wrong hands.

Critical Alert: Protect Yourself from Fraudulent Communications

Scammers are increasingly using trusted financial institution names to deceive innocent customers. These fraudulent individuals create fake websites, forge email addresses, and make deceptive phone calls claiming to represent legitimate companies like Home Credit India. Their goal is simple: to trick you into sharing personal information or making unauthorized payments that go directly into their pockets instead of legitimate business accounts.

As your trusted financial partner, Home Credit India wants to arm you with the knowledge and tools necessary to identify and avoid these sophisticated deception attempts. Understanding their tactics and knowing our legitimate business practices will help you protect your financial security and avoid falling victim to these increasingly common fraudulent schemes.

Recognizing Unauthorized Communications

Understanding what constitutes legitimate communication from Home Credit helps you identify potentially fraudulent attempts. Unauthorized communications often exhibit specific characteristics that differ from our official business practices.

Website and Email Verification: Our official website is exclusively www.homecredit.co.in. Any other domain name claiming to represent Home Credit should be treated with suspicion. Similarly, all legitimate emails from Home Credit end with "@homecredit.co.in" and never use personal email services like Gmail, Yahoo, Rediff, or similar platforms.

Payment Requests: Legitimate loan processes never require advance payments from customers before sanctioning or modifying loans. Any request for upfront fees, processing charges, or administrative costs through unofficial channels should raise immediate red flags. Also, never make payments to any unknown UPI ID shared through any unverified channel.

Communication Channels: Always verify that contact information matches what's listed on our official website. Unauthorized representatives might provide phone numbers or contact details that aren't associated with Home Credit's official customer service channels.

Home Credit's Official Business Practices

To help you distinguish between legitimate and potentially fraudulent communications, here's what you can expect from genuine Home Credit interactions:

Official Digital Presence: Our mobile application is available exclusively on Google Play Store under the name "Home Credit: Personal Loan App." We don't operate through any other app stores or unofficial applications. Our official website is www.homecredit.co.in and our official social media channels are linked to the footer on our main website.

Professional Communication: All official correspondence maintains professional standards and comes from verified email addresses ending with our official domain. We never use personal email accounts for business communications.

Transparent Processes: Legitimate loan modifications, foreclosure options, or interest rate discussions are always handled through official channels with proper documentation and transparent terms and conditions.

No Pressure Tactics: We never pressure customers to make immediate decisions without adequate time for consideration and verification. All legitimate offers provide sufficient time for you to review terms and ask questions.

Essential Protection Guidelines

Protecting yourself requires following specific safety protocols whenever you encounter communications claiming to be from Home Credit:

Verification First: Before responding to any communication, independently verify its authenticity by contacting us directly through our official website or customer care numbers. Never use contact information provided in suspicious messages.

Link Safety: Avoid clicking on links sent through unsolicited calls, text messages, or emails. Legitimate Home Credit communications requiring online action will direct you to our official website or mobile application.

Payment Authentication: Before making any payment through UPI or digital methods, ensure the recipient of the payment is verified as Home Credit and is not any individual or unofficial business entities.

Information Security: Never share personal banking details, passwords, or sensitive financial information through unofficial channels, regardless of how legitimate the request may appear.

Smart Response Strategies

When you receive communications claiming to be from Home Credit, follow these strategic approaches:

Independent Verification: Contact our official customer care team using the phone number listed on our website to verify any claims or offers mentioned in the communication.

Documentation: Keep records of suspicious communications, including phone numbers, email addresses, and message content, which can be helpful for verification purposes.

Official Channel Priority: Always prioritize information and offers received through our official website, mobile app, or verified customer service channels over unsolicited communications.

Banking Precautions: Consult with your bank before making any payments based on communications you haven't independently verified through official Home Credit channels.

Building Your Defense Strategy

Creating a robust defense against potential fraud requires ongoing awareness and smart practices:

- Stay informed about common fraud tactics and regularly review your financial statements for any unauthorized transactions. Maintain healthy skepticism toward unsolicited offers that seem unusually attractive or require immediate action.

- Keep our official contact information easily accessible so you can quickly verify any questionable communications. Regular communication with our official customer service team helps you stay updated on legitimate offers and company policies.

- Trust your instincts - if something feels suspicious or too good to be true, take time to verify before taking any action. Legitimate financial institutions always support customers who want to double-check information.

Our Commitment to Your Security

Home Credit India is committed to maintaining the highest standards of customer security and transparent communication. We continuously work to ensure our customers have access to clear, verified information about our services and policies.

Our customer service team is always available to help you verify communications and answer questions about legitimate Home Credit processes. We encourage you to reach out whenever you need clarification about any communication claiming to be from our company.

We also work diligently to maintain secure communication channels and regularly update our security protocols to protect against emerging threats in the digital landscape.

Conclusion

Your financial security depends on staying informed and vigilant. By understanding how fraudsters might potentially misuse Home Credit's name and following proper verification procedures, you can protect yourself from falling victim to deceptive schemes.

Remember that legitimate financial communications from Home Credit will always provide adequate time for verification and never pressure you into making hasty decisions. When in doubt, always contact us directly through our official channels.

Your awareness and caution are your best defenses. Stay informed, verify everything, and never hesitate to contact us when you need confirmation about any communication claiming to represent Home Credit India.

Official Contact Information:

- Website: homecredit.co.in

- Customer Care: +91 124 662 8888

- Email: care@homecredit.co.in

- Mobile App: https://www.homecredit.co.in/download-the-app

For Verification and Support:

- Always use official contact information listed above

- Verify any suspicious communications through our customer care

- Report concerns to our official customer service team

- Contact your bank immediately if you suspect unauthorized transactions

Stay vigilant, stay protected. When in doubt, verify with us directly.

Related Topics

- Financial Literacy

How Does Loan Against Property Work? Complete Guide

When you need access to large funds for personal or business purposes, selling your property isn’t the only option.

- Financial Literacy

4 Easy Ways to Know Your PF Account Number & Balance

Members of the EPFO program now have relatively easy access to the EPF facility thanks to the Employees’ Provident Fund Organization (EPFO).

- Financial Literacy

Rebuild Your Credit with These 5 Simple Ways

It might be more difficult to rebuild your credit than it is to start from scratch.

- Financial Literacy

Personal Loan Vs Line of Credit, What is the Best Option

Every line of credit exhibits different characteristics compared to a regular loan.

- Financial Literacy

Kill Your Financial Demons this Dussehra

India is the land of cultural diversities and celebrations.

- Financial Literacy

6 Major Pros and Cons of Refinancing Student Loans

Whenever you’re wishing to lower your interest rates & save some money, it’s favorable to use student loan refinancing. Though, refinancing is not the best option to choose from.

- Financial Literacy

How to Make Money Even While Sleeping?

How would it be to have money credited to your bank account even while you’re sleeping at night?

- Financial Literacy

How to Apply for a Home Loan in India- A Full Overview

Home loan or housing loan is a certain amount of money borrowed by an individual to purchase a house or any piece of residential property for a specific time period.

- Financial Literacy

How to prioritize Your Various Personal Financial Goals?

Ideating & building on financial goals is an important yet creative job for individuals, if not for all.

- Financial Literacy

How to Apply for Easy loan on Existing Business in India?

Just as difficult as it sounds a loan can be sanctioned by a bank, NBFC or an online P2P lending platform. P2P lending platforms are basically NBFCs as watched by RBI and the statutory bodies.

- Financial Literacy

Why is it Important to Have Additional Sources of Income?

Having additional sources of income is a necessity these days, and must be always worked for.

- Financial Literacy

Which are the most Featured Type of Credit Cards?

The gaining popularity of credit cards is quite evident & can be seen denting an impact on the lending & borrowing space.

- Financial Literacy

Smart Ways to Improve your Credit Score

As everyone is aware, a credit score is a statistical number that represents how you have used your credit over a specific period of time.

- Financial Literacy

Top 10 Important Financial Moves to Make Before Hitting 30

We all want to grow rich. We work round the clock, push our limits to work over-time, and shift jobs which offer a good pay.

- Financial Literacy

Credit Utilization Ratio: How Does it affect your Credit Position?

Credit utilization is defined to be the ratio of outstanding credit card balance to credit card limits.

- Financial Literacy

How is Credit Score Relevant to You?

All loan or credit card payments, repayments, defaults and more reflective in your credit history of the individual, using which the credit score is arrived at.

- Financial Literacy

How to Apply for a Home Loan in India

Home loan or housing loan is a certain amount of money borrowed by an individual to purchase a house or any piece of residential property for a specific time period.

- Financial Literacy

How to apply instant personal loan from Home Credit?

Home Credit is a leading personal loan provider in the fastest moving financial market.

- Financial Literacy

How is Home Credit a better option for Home Improvement Loan?

From the beginning of our career, we channelize our efforts to build an owned house.

- Financial Literacy

7 Tips to Manage your Finances Better

It is 1st of the month, and you get a message on your phone saying that some amount has been credited to your bank account.

- Financial Literacy

Everything you want to know about a Credit Score

To determine a credit score, several factors are considered as the type of employment, repayment potential, personal assets are verified before providing a loan.

- Financial Literacy

Tips for the first time ‘Cash Loan’ takers

Every first experience you have leaves you thrilled.

- Financial Literacy

How to Improve Your CIBIL Score and Why It Matters

We know that there are parameters to check the health status of an entity.

- Financial Literacy

How to get home equity loan with bad credit?

When you build a new house, you hope to build lifetime memories in it.

- Financial Literacy

How to break the Credit Cards addiction?

Are you carrying multiple credit cards in your wallet?

- Financial Literacy

How to Apply for Short Term Loan in India?

Majorly, personal loans are long-term and have high interest rates on the lent amount.

- Financial Literacy

Distinguish between business loan and micro loan.

The difference between a business loan and micro loan lies in the scope of the two.

- Financial Literacy

Quick Steps to Link your Mobile Number with Aadhaar-The New “Trust” Factor

About 1.2 billion people have an Aadhaar number today which is about a whopping 99% of the adult population of our country.

- Financial Literacy

6 Things that Show on Your Credit Report

There is no surprise to reveal that a credit report reflects on your past credit transactions.

- Financial Literacy

7 Things You Must Do for Successful Verification & Get Instant Cash Loan Approval

A few years ago, the lending process in India was cumbersome where

- Financial Literacy

How to apply for a Cash loan Online?

Getting cash loans have become easy nowadays.

- Financial Literacy

How to Get a Higher Credit Limit Easy?

Let us start with the main question whether you want to increase the credit limit or not.

- Financial Literacy

What is the Perfect Credit Score for a Small Business Loan?

To begin, small businesses typically base their operations on the investment received from reliable sources.

- Financial Literacy

Checklist for a Small Business Loan Application

Taking a small business loan from a reputed lender may increase your chances of quick loan approval.

- Financial Literacy

The System of Aadhaar Based Virtual ID

Unique Identification authority of India (UIDAI) has launched Aadhaar Virtual ID also known as VID, a temporary ID to be used at all places.

- Financial Literacy

Reasons Why You Should Approach an Online Lender for Loans

We all need to borrow money at some point in our lives to fulfill our goals and desires.

- Financial Literacy

Financial Lessons to be learnt this Diwali

Diwali, the festival of lights offers interesting financial lessons which can be used for future planning.

- Financial Literacy

How Payments Banks are different from Regular Banks

Payment banks are primarily based on the new business model proposed by the Reserve Bank of India.

- Financial Literacy

How do Credit Cards Work and What to Know?

A credit card is a convenient mode of payment made of plastic that allows you to make purchases online/ offline without parting cash.

- Financial Literacy

Safeguard Your Financial Journey with Home Credit Safe Pay

In a world that’s constantly evolving, financial security has taken on a new level of importance.

- Financial Literacy

Ways Women Can Manage Their Finances Independently

In our patriarchal society, women have been put down for decades

- Financial Literacy

Can’t find a guarantor for a loan? Here’s what your option

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours.

- Financial Literacy

Aadhaar Virtual ID – How Safe is it?

You will now be using your Aadhaar virtual ID or VID similarly as you utilize your Aadhaar card details when it comes to banking operations, telecom organizations and so on.

- Financial Literacy

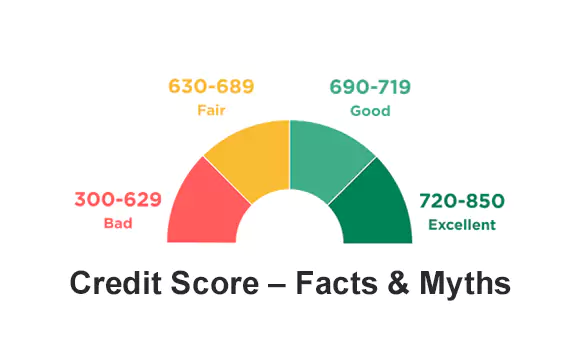

Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later.

- Financial Literacy

Reasons Why Instant Loans Help You Overcome Emergency Situations

Life is unpredictable; you never know what it may have in store for you.

- Financial Literacy

Why Are There Different Types Of Credit Scores?

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan.

- Financial Literacy

Aadhaar Virtual ID And its Benefits

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID.

- Financial Literacy

Virtual ID in the Real World

Have you heard about Virtual ID? UIDAI introduced Virtual IDs after facing concerns over security of users’ data.

- Financial Literacy

Tired of Unwanted Calls? Reclaim Your Peace with TRAI DND!

In today’s digital age, our phones are irreplaceable, but they also bring tons of unwanted calls and messages.

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

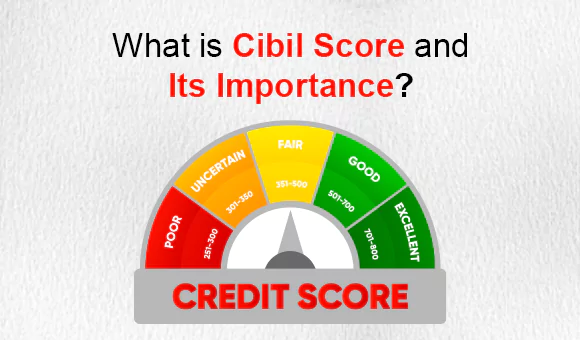

What is CIBIL Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

Understanding Personal Loan Interest Rates and Calculations

Personal loans can be a great way to manage big expenses or emergencies, but do you know how their interest is calculated? It’s not as tricky as it seems!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.