Do you have everything you need to apply for a loan!

Arvind’s neighbour, Sameer had been planning to buy his first car ever since he started earning two years ago. Being a car enthusiast, he diligently saved up for the down payment and researched on which car to buy. He also decided to take a loan to fund his dream car.

One evening while waiting for the elevator, Arvind struck a conversation with Sameer. Since the car was all Sameer had been thinking about lately, it wasn’t long till they reached the topic.

Arvind: Congrats on finding the right car. Have you checked the financing options?

Sameer: Not yet. I’ve only just finalised the car model. I hope the car dealer will offer a few options.

Arvind: Well, as long as you are eligible for a loan, you won’t face a problem.

Sameer: Eligible? The car dealer said he would take care of everything. I just have to provide my Pan card, Aadhar card, and income details.

Arvind: There’s more to taking a loan than that. Lenders check your ability and intention to repay to ensure they don’t lose money. And it’s the lender and not the dealer, who will consider multiple factors including the documents and assess your eligibility for the loan.

Sameer: I think I’m missing a lot of things. Can you please spare some time to fill me in?

Arvind: Yeah, sure. Here is what you can do to increase your chances of loan approval.

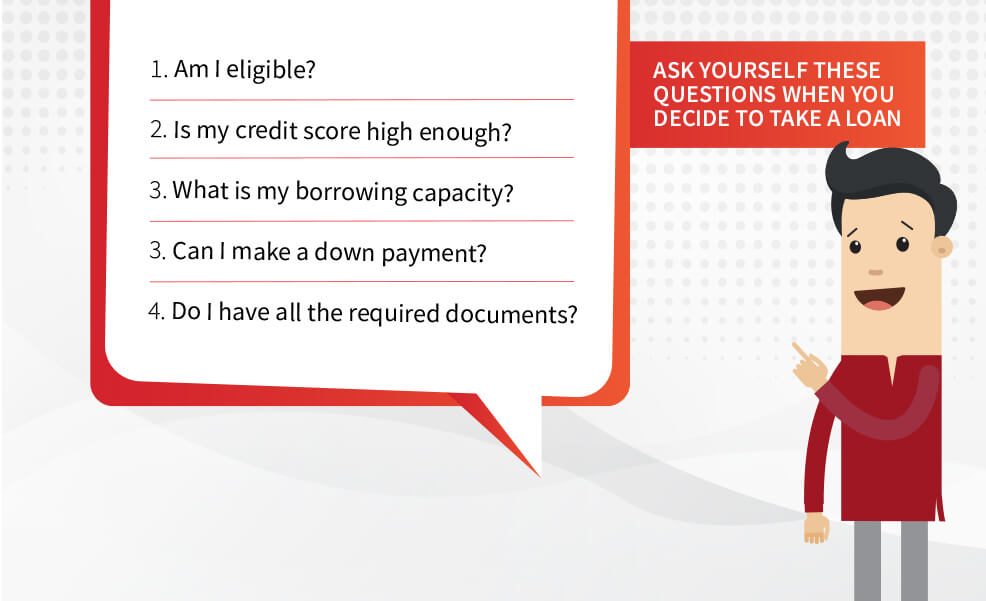

1. Ensure your credit score is impressive

One of the most important deciding factors for loan approval is your credit score.

It is based on your repayment behaviour on your existing debts, the number of loans that you have, how often you are applying for loans, etc. The closer your score is to the upper limit, 900 points in the case of CIBIL TU, the higher are your chances of getting loan approval.

As per CIBIL TU, a credit score equal to or more than 750 is generally considered good and is one of the most important considerations during loan assessment.

Ensure that all the information in your latest credit report is up to date, accurate, and belongs to you. As errors or overdue payments may negatively impact your score.

If you fear loan rejection due to bad credit score, read How to improve a damaged credit score?

2. Maintain your Debt-to-Income ratio

Ask yourself, how many loans are you currently repaying, and if you can accommodate another loan instalment in your income? Will you be able to continue repaying your loans in an unforeseen situation?

Typically, a Debt-to-Income ratio of less than 40% is considered positive by most lenders. Exceeding this limit shows lenders that you are overly dependent on loans and may fail to repay your dues, which can impact the approval decision itself or the loan amount, term, and interest rate that you may be charged.

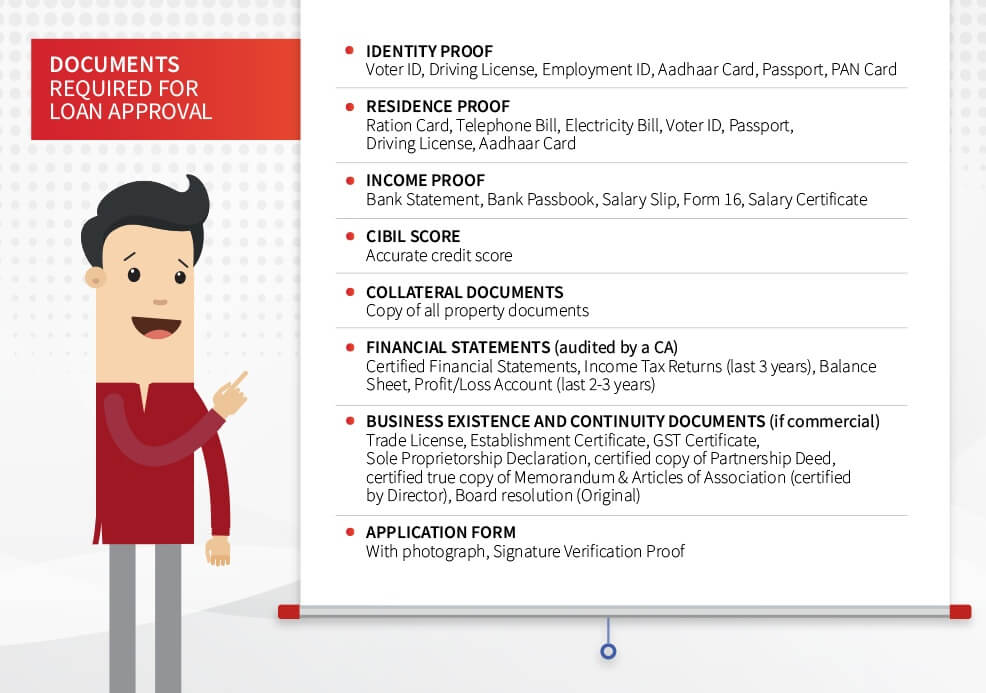

3.Update all documents and keep them ready

Lenders need to verify your personal, professional, and credit details to assess your creditworthiness, prevent fraud, and to be able to contact you easily. They will follow the KYC (Know Your Customer) process laid down by the RBI and establish your identity, which requires documents such as Aadhaar card, Passport, Driving license, salary slips, etc.

Ensure that you have the original copy of these documents, and the information is correct. Keeping the required documents ready before applying for a loan reduces delays and improves the chances of loan approval.

4. Down-payment

Down payment helps you save on interest costs by reducing the amount you actually borrow. This shows that you want to keep your monthly instalments small and reduce the risk of delay or non-payment of dues. The portion of the commodity's price that you borrow is known as Loan to Value (LTV). Lower the LTV, the more comfortable are loan companies about approving loans.

Some lenders are strict about having the processing fees and down payment amount in your bank account for at least sixty days before applying for the loan. This is known as deposit seasoning. It is done to ensure that you haven’t received the money from anyone else or loaned it.

There you go, Sameer. I hope this information helps.

Sameer: I was taking this so lightly. Thanks for sharing all the information with me. I better pull my socks up and start preparing. I will start by discussing the loan terms with the lenders, putting my documents together, and making sure the details in my credit report and submitted documents are correct.

Arvind: That's a good start. All the best!

Being well prepared before taking a loan doesn’t just ensure that you get the loan easily and faster; it also reduces the chances of loan rejection.

Read Questions you didn't know whom to ask about your credit report and score to know how to make the best borrowing decisions.

Related Topics

- Managing Debts

Making the Right Financial Decisions Through Financial Literacy

In a world driven by constant change and economic uncertainties, the ability to make informed financial decisions is more crucial than ever.

- Managing Debts

How To Keep Yourself Safe From Online KYC Scams?

In an era dominated by digital interactions, the convenience of online services comes with an inherent risk

- Managing Debts

Why 77% of Working Professionals Rely on Personal Loans?

In today's fast-paced world, managing finances can be a daunting task for working professionals.

- Managing Debts

How to Choose Your Ideal Repayment Tenure for Personal Loans?

Personal loans have become an indispensable financial tool for many individuals, offering a quick and convenient way to address various financial needs.

- Managing Debts

Top 10 Ways to Identify Personal Loan Scams Online

In a world driven by digital advancements, online personal loans have become increasingly popular in India.

- Managing Debts

What is Repo Rate? How Does it Affect the Economy?

Have you ever heard the term "repo rate" and wondered what it's all about? Well, you're not alone.

- Managing Debts

What is Debt to Income Ratio and How is it Calculated?

Managing your finances wisely is essential for a secure financial future. One crucial aspect of financial health that often gets overlooked is the Debt-to-Income Ratio (DTI).

- Managing Debts

Things to Tell Your Child When They Apply for Their First Personal Loan

As your child ventures into adulthood, they will face various financial milestones, one of which may be applying for their first personal loan.

- Managing Debts

How Can a Personal Loan Be Used as an Investment?

In today's fast-paced world, financial goals and dreams are many. Whether it's pursuing higher education, starting a small business, or renovating your home, we all have aspirations that require financial support.

- Managing Debts

5 Smart Tips For Easy Personal Loan Management

In today's world, personal loans have become an important financial tool to help individuals meet their financial goals. Be it organizing a wedding, buying a car or house, or even consolidating debt, personal loans can provide much-needed financial help.

- Managing Debts

Did you know credit scores affect your job prospects besides future borrowing!

You may have heard about credit scores if you have applied for a loan. But most of you may not know about its impact on things apart from your borrowings. This piece can help you understand other such ways in which your credit score may affect you.

- Managing Debts

Things you should always check while borrowing money

Interest rate is what a loan company or bank charges for the loan amount they grant you. It is an important factor that determines the total cost of the loan.

- Managing Debts

Could your decision to take another loan make you regret later!

Have you ever made an impulsive purchase and regretted later? Or fell into the trap of a promotional offer? This article tells you the important questions that you must ask before deciding to borrow money for anything.

- Managing Debts

What is a budget? Why is it so important!

Budgeting is the solution of most financial problems. In this listicle, learn about what budgeting is and its many benefits.

- Managing Debts

Heard of paying yourself first? – Here is why it is important

Paying yourself first ensures you always save money. Read on to understand more about what it is and how it can help you.