Could your decision to take another loan make you regret later!

It had been eight months since Arvind and Nisha moved into their new house. The house is small, but it is airy and beautiful. Nisha is obsessed with the natural light that floods the rooms and highlights every corner of the house.

One day, as they were enjoying their morning tea, Nisha noticed an ad in the newspaper for a minimalist and modern sofa set, that too on easy instalments at just 1% interest per month. She decided to find out how Arvind felt about the same.

Nisha: Look, Arvind. What a beautiful sofa set. Don’t you think it’ll look perfect in our living room?

Arvind: Yes, it sure would. But tell me, is there something wrong with the one we have?

Nisha: I knew you would say that. We’ve had this one for so long. It’s almost seven years old, and the design is so outdated. This is the problem with you, Arvind. You never buy things when they are at their best price. You know, I have an eye for great offers. We should buy things when there is a good deal available.

Arvind: We should buy things when we need them and can afford them, Nisha. Offers will come and go. It’s not been long since we moved here, and we just got a new car. Taking loans for things just because a newer and more fashionable model has come out can disturb our monthly budget. So, let’s think this purchase through and ask ourselves some questions before we make a decision.

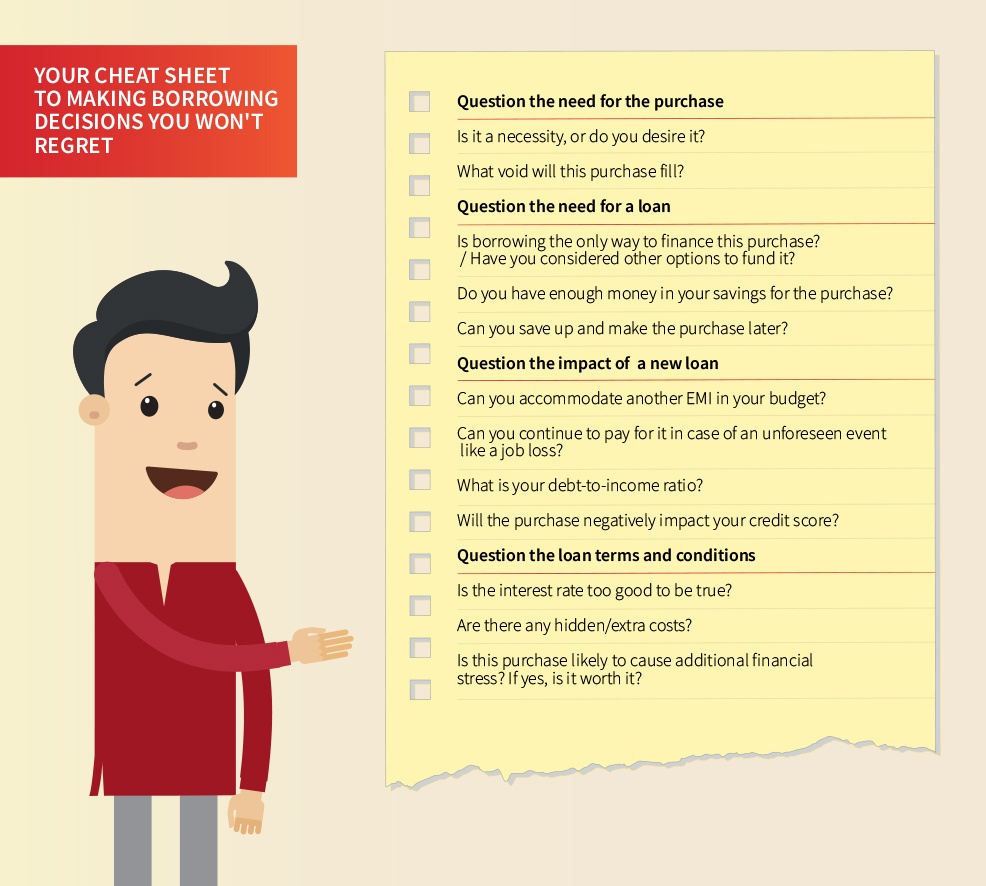

Question the need for the purchase

Arvind: I understand that our sofa is old, but do we need a new one urgently or is it just a desire? And anyway, does it help us achieve anything?

Nisha: Oh well. I just wanted the house to look nicer before the next kitty party. New house, new sofa, new look, you know!

Question the need for a loan

Arvind: I’m sure you’d like a new sofa, Nisha. Do we really need to take a loan for the same? Is there another way to pay for it?

Do you think we have enough savings to be able to afford this sofa?

Nisha: We used most of our savings to pay the down payment on our new house and car, that's why the 1% loan will help!

Arvind: We’re already paying two EMIs and credit card bills along with other monthly expenses. Plus, we need to pay our LIC premium in the next two months. We are also going on a road trip next month with your sister. Having to pay another EMI might get stressful.

Nisha: Hmm, you have a point here.

Arvind: Let's think, can we save up instead and buy it later? It can be one of our short-term goals. If we start saving now, we can buy a new sofa by Diwali.

Question the impact of a new loan

Arvind: Let's assume we decide to take the loan. We must ask ourselves if we would be able to continue paying the EMIs for the next 12 months. You know that my company is reducing its workforce. What if I’m one of those who stand to lose their job?

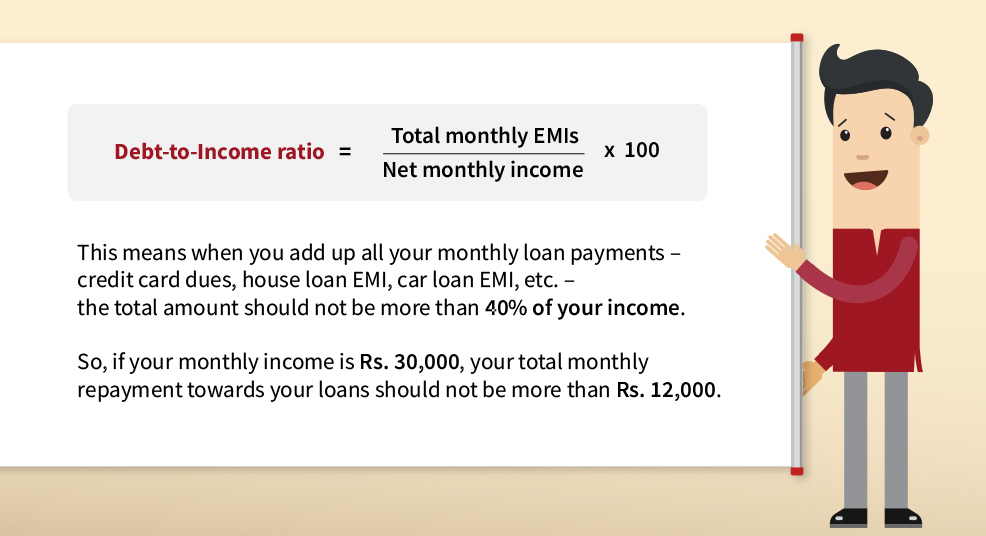

Besides that, taking another loan may push our Debt-to-Income ratio beyond healthy limits.

This can lower our credit score too. We’ve recently taken two big loans, so adding another loan could make it look as if we are excessively dependent on credit.

Question the loan terms and conditions

Arvind: Finally, how do we know that this offer at just 1% interest is not a marketing trick? To be sure, we must find out if there are any hidden charges that could make the loan more expensive than it seems.

Nisha: Hidden charges? Can that actually happen?

Arvind: Of course, it can. Tabhi toh kehta hun, we shouldn’t make any financial decisions without assessing every aspect of it. Taking a loan is like the seeds you sow in our garden. The fruits the plants bear, should make our lives financially healthier and happier; and not stress us out or hurt us.

Nisha: That makes sense. You are so smart, Arvind.

Financial commitments can build or break us. That’s why we should always ask ourselves if a purchase is worth the financial stress that it may cause.

Watch Do you really need to borrow? to know how Vidhi learnt a borrowing lesson.

Related Topics

- Managing Debts

Making the Right Financial Decisions Through Financial Literacy

In a world driven by constant change and economic uncertainties, the ability to make informed financial decisions is more crucial than ever.

- Managing Debts

How To Keep Yourself Safe From Online KYC Scams?

In an era dominated by digital interactions, the convenience of online services comes with an inherent risk

- Managing Debts

Why 77% of Working Professionals Rely on Personal Loans?

In today's fast-paced world, managing finances can be a daunting task for working professionals.

- Managing Debts

How to Choose Your Ideal Repayment Tenure for Personal Loans?

Personal loans have become an indispensable financial tool for many individuals, offering a quick and convenient way to address various financial needs.

- Managing Debts

Top 10 Ways to Identify Personal Loan Scams Online

In a world driven by digital advancements, online personal loans have become increasingly popular in India.

- Managing Debts

What is Repo Rate? How Does it Affect the Economy?

Have you ever heard the term "repo rate" and wondered what it's all about? Well, you're not alone.

- Managing Debts

What is Debt to Income Ratio and How is it Calculated?

Managing your finances wisely is essential for a secure financial future. One crucial aspect of financial health that often gets overlooked is the Debt-to-Income Ratio (DTI).

- Managing Debts

Things to Tell Your Child When They Apply for Their First Personal Loan

As your child ventures into adulthood, they will face various financial milestones, one of which may be applying for their first personal loan.

- Managing Debts

How Can a Personal Loan Be Used as an Investment?

In today's fast-paced world, financial goals and dreams are many. Whether it's pursuing higher education, starting a small business, or renovating your home, we all have aspirations that require financial support.

- Managing Debts

5 Smart Tips For Easy Personal Loan Management

In today's world, personal loans have become an important financial tool to help individuals meet their financial goals. Be it organizing a wedding, buying a car or house, or even consolidating debt, personal loans can provide much-needed financial help.

- Managing Debts

Did you know credit scores affect your job prospects besides future borrowing!

You may have heard about credit scores if you have applied for a loan. But most of you may not know about its impact on things apart from your borrowings. This piece can help you understand other such ways in which your credit score may affect you.

- Managing Debts

Things you should always check while borrowing money

Interest rate is what a loan company or bank charges for the loan amount they grant you. It is an important factor that determines the total cost of the loan.

- Managing Debts

Do you have everything you need to apply for a loan!

Are you planning to take a loan soon? But are you fully prepared to take the loan? Here’s a checklist you must read to make sure your loan application is processed and approved easily.

- Managing Debts

What is a budget? Why is it so important!

Budgeting is the solution of most financial problems. In this listicle, learn about what budgeting is and its many benefits.

- Managing Debts

Heard of paying yourself first? – Here is why it is important

Paying yourself first ensures you always save money. Read on to understand more about what it is and how it can help you.