Credit history is your financial collateral

- Credit history is your financial collateral

Where to get your credit report, How to read it!

A lot of people find it difficult to understand their credit reports. This piece tell you how to read your credit report section by section and helps you understand which portions mean what, like the first portion contains personal details,the second portion reflects one;s employment details like income, the next portion has details about the loans acquired and their history, etc.

Borrowing and credit basics

- Borrowing and credit basics

Do you know the difference between good and bad debts!

This article will help readers differentiate between good and bad debts. It talks about the basic factors like cost, if the loan helps you build an asset, if it helps you secure your future, etc. that differentiate good debts from bad ones.

Trending Videos

Personal loans se jude 5 myths

We are often conflicted on whether a loan will help our finances or not. This video will help bust 5 common myths associated with personal loans and how we can leverage them to make smarter financial decisions for ourselves and our loved ones.

Kya ₹ 25000 ki salary par loan mil sakta hai?

Can you get a loan with a monthly income of ₹ 25000? Watch this video to get insights into how one can use easy EMI’s to buy things they may need or desire with this.

Personal Loan lein ya na lein?

Understand the pros and cons, that one can encounter upon taking a loan. Watch this video & know how a loan, when taken with the right considerations and precautions, can help increase benefits and make financially responsible decisions.

Home Credit Personal Loan mein EMI par khareedari karne se pehle inn baaton ka dhyaan rakhiye!

EMIs ki madad se apni zaroorat aur pasand ki cheezo ki shopping karna hai bohot aasaan! Lekin, Personal loan lene ya phir EMI par kuch bhi khareedne se pehle aapko kuch baaton ka dhyan rakhna zaroori hai, taki kisi problem ke chalte aapke credit score par asar na pade. Chaliye, samajhte hain Home Credit ke saath EMI par khareedari karne ke terms aur conditions ko.

EMI par khareedari karne se pehle Home Credit ke sath jainye kin baaton ka khayal rakhna chahiye?

Agar aapko apne liye khareedari karni hai, ghar ke liye naya home appliance khareedna hai ya apno ki wishes ko pura karna hai, toh asaan EMI iska solution ho sakta hai. Lekin EMI lene se pehle aapko kai baaton ka dhyan rakhna zaroori hai taki kisi problem ke chalte aapke credit score par asar na pade. EMI par khareedari karne ke terms aur conditions samjhne ke liye, Home Credit ke saath bane rahiye.

Jaaniye kaise Home Credit ki madad se aap kar sakte hai apne financial goals ko poora?

Kya aap apne financial goals ko achieve karne, savings ko badhane, aur financial status ko behtar banane ki tension mein hain? Home Credit aapke liye lekar aaya hai savings grow karne ke easy tips, jinse aap apni financial goals ko achieve karne ki struggle ko kam kar sakte hain aur apne sapno ko poora kar sakte hain. Aayiye humare sath janiye yeh easy tips.

Kya aap bhi apne financial goals ko poora karna chahte hai?

Kya aap bhi apne financial goals poora karna aur apni savings ko future ke liye grow karna chahte hain?Home Credit le aaya hai aapke liye iska aasaan solution! Jaanne ke liye bane rahiye humare saath.

Do you really need to borrow?

Vidhi, Arvind’s sister, is an impulsive buyer and constantly borrows money to fulfil her needs and wants. This has strained her relationships and landed her in a debt trap which is making it harder for her to manage her finances. But Arvind helps her understand that she should only take loans when necessary

How to control your dues before it controls you?

When we fall ill, we consult a doctor and make lifestyle changes. Similarly, when we fall into a debt trap, we should seek help and re-adjust our finances. In this video, Arvind introduces 5-mantras to Ravi, that’ll help him get out of debt.

What are the important factors to consider when borrowing?

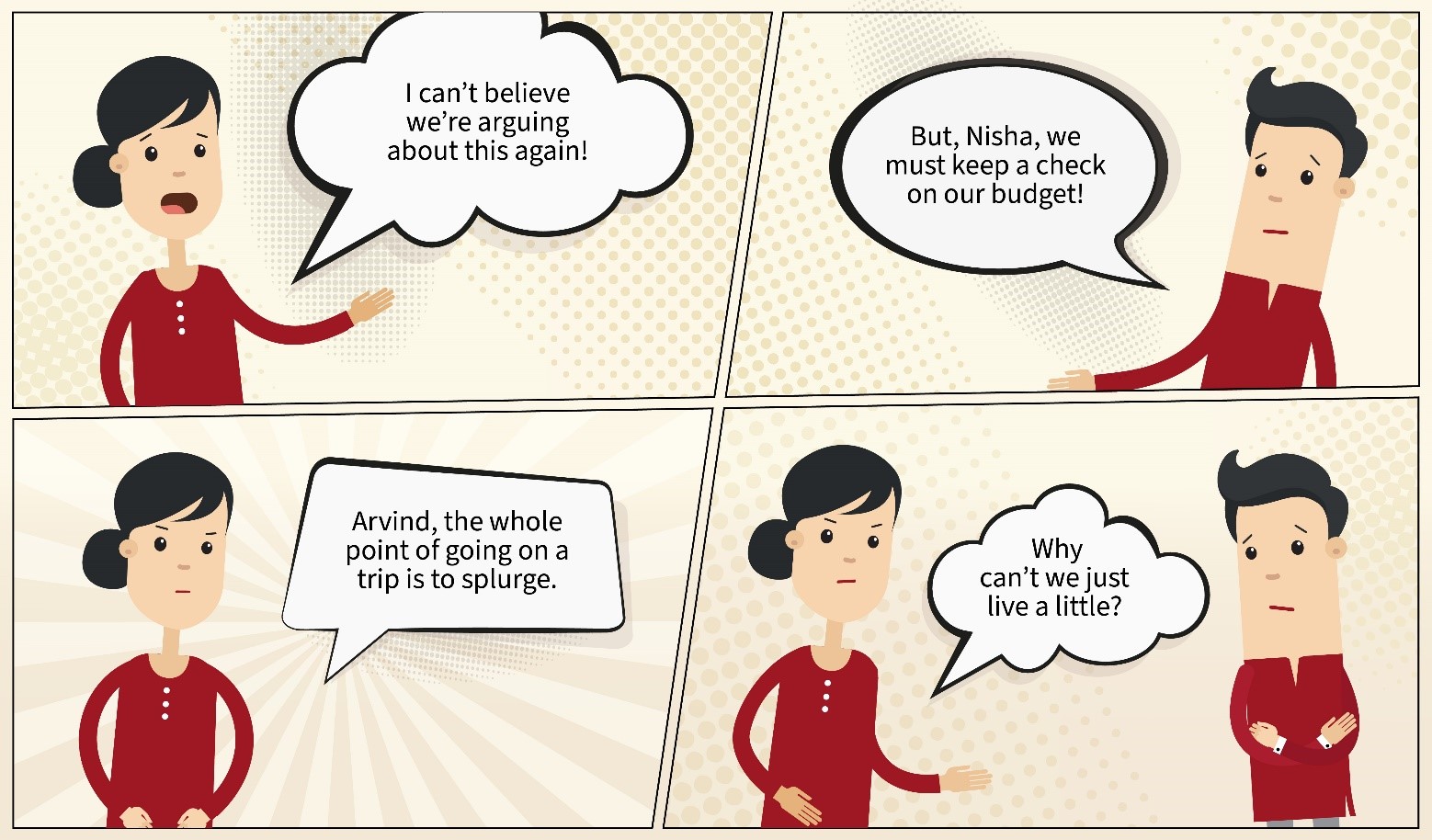

Through this small incident from Arvind and Nisha’s life we learn that we should research well and compare deals before taking a loan, just like we browse through markets and check the quality of anything we buy – be it groceries or clothes. Arvind tells Nisha about all the important factors – like interest rate, tenure, additional fees and charges, etc. that she should check before taking a loan

Can the borrowings be good?

Loans are not good or bad; it’s how and what we use them for that makes the difference. This is what Arvind helps Nisha understand by comparing loans with relationships. Loans should help you achieve your financial goals, but when they start straining your finances, you should step back and reconsider them

Why having a bank account is important?

When Nisha hands over their house help Savitri’s salary to her, she requests Nisha to keep it for her so that the money remains safe. This is when Nisha and Arvind explain to Savitri, how having a bank account would not only keep her money safe but provide her with other benefits too. Watch the video to know why having a bank account is important.

Why do you need an emergency fund?

Arvind and Ajay are having lunch at their office when Arvind tells Ajay about the ongoing layoffs in their company. This gets Ajay worried as he has a lot of liabilities and expenses to take care of. Arvind introduces Ajay to the concept of emergency fund and explains why he should start saving for one immediately. Watch the video to know why an emergency fund is indispensable.

Why budgeting is important?

Arvind and Vidhi are in their house where Vidhi is reading a pamphlet. Vidhi gets excited to know that a famous tarot card reader, Wang Skyler is coming to their society. She is really excited to know about her future. Vidhi is surprised when the tarot card reader tells her that all her problems will be solved if she starts budgeting. Watch the video to know how budgeting will help Vidhi.

Effective budgeting: How to make it interesting?

Arvind performs a magic trick during his society’s talent mela. He also takes the opportunity to educate people about tips and tricks to save money and how these small changes in expenses, can make a big difference in budget. Watch the video to know how to budget better.

Old vs New: Effective ways to save money

Arvind and Nisha’s nephew Adi gets a new job. As the whole family celebrates together, they share with Adi, some age old and some modern ways to save money. Adi understands the importance of starting early with savings and gets to know about a lot of options that he could choose from. Watch the video to know how you can save money like Adi.

Why is it important to save money?

We look at the journey of two childhood friends, Arvind and Hari who have a very similar life path until they start their job. While Arvind budgets and saves, Hari spends without a plan. We see how a series of unplanned expenses and the lack of a budget or saving plan, lands Hari in trouble. Arvind comes to his rescue and shares solutions to get his finances back on track. Watch the video to know how Arvind helps Hari.

How to control your debts before they control you

When we fall ill, we consult a doctor and make lifestyle changes. Similarly, when we fall into a debt trap, we should seek help and re-adjust our finances. In this video, Arvind introduces 5-mantras to Ravi, that’ll help him get out of debt.

Badhayein Apni Savings 5 Aasan Tareeko Se

Home Credit Paise ki Paathshala ke is video mein hum laye hain aapke liye 5 tips jiske zariye aap apni savings badha sakte hain. Jaaniye kaise aap apni rozana zindagi mein paise bacha kar apni aur apne parivaar ki #ZindagiHit bana sakte hain.

Credit Score Kya Hota Hai Aur Isse Kaise Badhayein?

Aapne zaroor suna hoga, 'Credit Score.' Isliye, hum laye hain aapke liye ye video. Home Credit ke Paise Ki Paathshala ke is video mein hum baat karenge Credit Score ya CIBIL Score ke baare mein. Aur iske saath hi, jaanenge apne Credit Score ko badhane ke 4 tareeke aur kuch aisi myths ke baare mein jo Credit Score se judi hain.

Home Credit Ujjwal EMI Card Se Karein Aasaan EMIs Par Shopping

Home Credit Paise Ki Paathshala ke is video mein hum laye hain saari jaankari, jo Home Credit Ujjwal EMI Card ke saath judi hai. Jaaniye kaise aap ₹75,000 tak ki pre-approved limit ke saath aasaan EMI options ka labh utha sakte hain apne pasandida products ko kharidne ke liye.

Kya Aap Financial Decisions Lene Se Ghabrati Hain?

Financial Independence is Non-Negotiable! #PaiseKiPaathshala ke iss naye video mein, hum baat karenge un financial basics ki jo har woman ko zaroor pata hone chahiye. Kyunki sahi knowledge se hi decisions bante hain strong, aur financial independence aati hai.

Latest Updates

Kya Aap Financial Decisions Lene Se Ghabrati Hain?

Kya Aap Financial Decisions Lene Se Ghabrati Hain?

Jaanniye Aasaan Tareeke EMI Ka Bhugtan Minton Mein Karne Ke!

Jaanniye Aasaan Tareeke EMI Ka Bhugtan Minton Mein Karne Ke!

Home Credit Ujjwal EMI Card Se Karein Aasaan EMIs Par Shopping

This article will help readers differentiate between good and bad debts. It talks about the basic factors like cost, if the loan helps you build an asset, if it helps you secure your future, etc. that differentiate good debts from bad ones.

6 Crucial Debt Management Tips to Learn & Apply In 2025

Are you struggling with managing your debt? You're not alone. Many people face challenges when it comes to debt management. However, with a few tips, you can learn to manage your debts effectively. In this blog post, we will discuss six important debt management tips that you can learn and apply in 2025.

5 Ways to Protect Yourself from Financial Fraud

In today's digital age, financial fraud is becoming increasingly common. Scammers are constantly devising new ways to trick unsuspecting individuals into revealing their personal information or making fraudulent transactions.

Things to Tell Your Child When They Apply for Their First Personal Loan

As your child ventures into adulthood, they will face various financial milestones, one of which may be applying for their first personal loan.

Right time to start saving: In your 20s or 30s!

This infographic shows when you should start saving and why through Aisha and Riya’s stories.

How to Set Personal Finance Goals?

In the pursuit of financial stability and success, setting clear and achievable personal finance goals is a crucial step.

Talk to the loan company for help

This is the last piece of the mantras series. In this piece, Arvind talks about the various ways your loan company can help in case of default. It suggests steps like contacting your lender asap and informing them about the reason for the delay, sharing your previous repayment history with them, etc. and informs you of the ways your loan company can help you deal with your debt. Then he informs Ravi about some ways his lender can help his deal with his debts.

7 Best Investments Options in India

Are you thinking about making your money work for you? Investing is a smart way to grow your savings over time.

Where to get your credit report, How to read it!

A lot of people find it difficult to understand their credit reports. This piece tell you how to read your credit report section by section and helps you understand which portions mean what, like the first portion contains personal details,the second portion reflects one;s employment details like income, the next portion has details about the loans acquired and their history, etc.

Why should I save money when getting loans is so easy!

While taking a loan might be an easy option, it’s not advisable to borrow unnecessarily. Learn more about benefits of saving regularly and consistently.

What is a budget? Why is it so important!

Budgeting is the solution of most financial problems. In this listicle, learn about what budgeting is and its many benefits.

Know where all your money is going before you start budgeting

Vidhi complains to Arvind that despite budgeting as he had suggested, she still isn’t saving enough. Read this comic strip to know why and how Arvind helped her find a way to save thousands of rupees!

How to figure out how much to save in an emergency fund!

If you want to save but don’t know how much to, read this infographic to choose a method that suits you best from three easy options.

How to Set S.M.A.R.T Financial Goals?

In today's fast-paced world, setting financial goals is crucial to secure a stable future.

Here’s how couples can benefit from budgeting together

In this listicle, read about common budgeting mistakes couples make and how you can overcome them to achieve all your financial goals together.

Financial Lessons To Learn From the Holiday Season

The holiday season is a time of joy, celebration, and spending time with loved ones.

How Can a Personal Loan Be Used as an Investment?

In today's fast-paced world, financial goals and dreams are many. Whether it's pursuing higher education, starting a small business, or renovating your home, we all have aspirations that require financial support.

Questions you didn't know whom to ask about budgeting

Do you want to start budgeting but don’t understand how? We’ve answered budgeting FAQs that can help you kickstart your journey.

How can you protect your family with life insurance!

Sahu ji is worried about his family’s wellbeing but doesn’t have a life insurance plan yet. Arvind helps him understand why it is important to get one.

7 Budgeting pitfalls that can push your finances off track

Feel like your budget isn’t quite working? You could be making any of the budgeting mistakes listed here. Read on to know how Seema and Uday fixed their budgets successfully.

Ways to Get in Better Financial Shape in 2024

As we step into a new year, many of us are eager to make positive changes in our lives, and one area that often takes center stage is our finances.

Understanding Risk Management in Wealth Planning

Wealth planning is essential for achieving financial security and prosperity. However, the road to build and preserve wealth is not without its share of risks. To ensure a successful journey, it is crucial to understand and effectively manage these risks. In this blog, we will explore the concept of risk management in wealth planning.

How Can Personal Loans Help You Achieve Financial Independence?

In a world where financial goals often seem elusive, personal loans emerge as versatile tools that can empower individuals on their journey towards financial independence.

What is Repo Rate? How Does it Affect the Economy?

Have you ever heard the term "repo rate" and wondered what it's all about? Well, you're not alone.

Questions you didn't know whom to ask about budgeting

Do you want to start budgeting but don’t understand how? We’ve answered budgeting FAQs that can help you kickstart your journey.

Budget Planning Tips For A Better Financial Future

In a world marked by economic uncertainties and rapidly changing financial landscapes, effective budget planning is the cornerstone of a secure and prosperous future.

Which Saving Schemes Are The Best To Invest?

Saving money is a crucial aspect of financial planning, and choosing the right saving schemes can significantly impact your wealth accumulation.

How to Choose Your Ideal Repayment Tenure for Personal Loans?

Personal loans have become an indispensable financial tool for many individuals, offering a quick and convenient way to address various financial needs.

Choose a systematic method to pay your debt

Arvind and Ravi are halfway through their 5 mantra plan and are meeting to discuss the third mantra - Adopt a method to pay debt systematically. Arvind helps Ravi chart out a workable method, which is best suited to his situation to pay off his debts.

Investing Wisely: Tips for Growing Your Wealth

Building wealth is a goal shared by many, but it can often seem like a complex and overwhelming task. However, with a few simple strategies and a basic understanding of investing, you can set yourself on the path to financial success.

Teach your kids the whys and hows of money management

Responsible children grow up to be wise adults. Give your children the tools to become financially successful in the future with these tips.

How to Use 80C Deductions to Reduce Your Tax Burden?

Ever feel like you're paying too much in taxes each year? You're not alone. As a salaried employee, a huge chunk of your income goes towards taxes. But here's the good news: there are legal ways to reduce your tax burden. Section 80C of the Income Tax Act 1961 allows you to claim deductions on select investments and expenses.

How important is it to have medical insurance!

Sameer understood the importance of having medical insurance only after getting into an accident. Here’s what you can learn from his experience.

Could your decision to take another loan make you regret later!

Have you ever made an impulsive purchase and regretted later? Or fell into the trap of a promotional offer? This article tells you the important questions that you must ask before deciding to borrow money for anything.

9 modern ways to save money

ONLY KEEP AS MUCH CASH AS YOU NEED This will help you reduce impulsive spending and stay aware of every rupee you spend

Why is it essential to have a bank account today!

While you might have a bank account, do you truly understand its benefits? Read on to know all the ways you can benefit from having one.

Where can you find extra funds to save!

Every small drop makes an ocean. Similarly, every rupee you save could come to use in the future. In this article, we offer you ways to save money in the most unlikely of ways.

Where to park your emergency savings!

While emergency funds are meant to be easily accessible, that doesn’t mean you should store it all in cash. Instead, follow these tips to keep them secure yet accessible.

4 Most Common Types of Dividend Policies

When investing in the stock market, one of the most attractive aspects for investors is the potential to receive dividends. A dividend is a portion of a company's profits that is distributed to its shareholders. However, not all companies follow the same approach when it comes to distributing dividends.

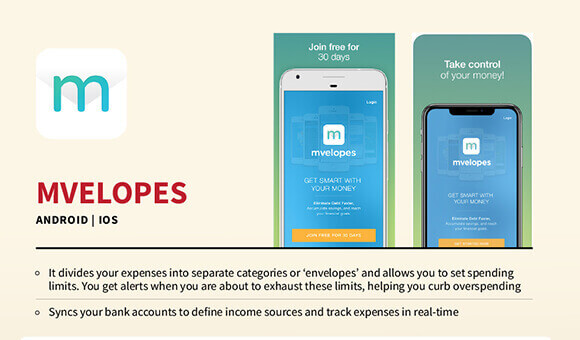

8 budgeting apps that can make money management easier

GET SMART WITH YOUR MONEY MVELOPES. It divides your expenses into separate categories or 'envelopes' and allows you to set spending limits.

How to keep your money safe from yourself!

Make your budget water-tight by using these tips to keep yourself from misspending your money.

Why is it important to have an emergency fund, How can you build one!

An emergency fund can provide a cushion in various situations. Read on to understand why you need it, and how you can build one.

Are you making these saving mistakes!

Saving money is imperative but making stupid mistakes can water down your efforts to save. Here are some common mistakes to avoid.

Long-term vs. Short-term Investments: Pros and Cons

When it comes to investing your hard-earned money, it's important to have a clear strategy in mind. Two common approaches are long-term and short-term investments.

Are you overestimating your income when budgeting!

Overestimating income is a more common mistake that you would think. In this article, we give you step-by-step guides to avoid spending with the assumption of having more money.

How Personal Loan Apps Are Leading To A Financially Healthy India?

In recent years, the landscape of personal finance in India has undergone a transformative shift, thanks to the emergence of innovative financial technologies.

Mantra 4 - Dig into your long-term savings to secure your today

You save money to secure your future, but your present may need it more at times. Particularly when dealing with excessive debt, savings and investments can help you repay them sooner. Find out how Arvind helped Ravi identify sources of extra money to clear his debts.

Is your debt controlling you? Read this to know

Debts can either help you achieve life goals sooner or pull you farther away from them. Ravi was struggling with his loans too, but Arvind told him about these 5 mantras that will help him get out of debt.

5 Tips to Spend Less & Save More this Festive Season

The festive season is a time of joy, celebration, and togetherness.

How much debt is too much

We all need to borrow money at some point in our lives. But it is very important to know when to stop and reassess our finances. This article mentions indicators that can tell you if you have more debt than you can comfortably repay.

Here’s how to budget to achieve your dream lifestyle

Everyone has their idea of a dream lifestyle. Follow these steps to create a budget so that you can achieve yours.

Boost Your Income With 3 Best Investment Plans

In a dynamic and ever-changing economic landscape, the quest for financial stability and growth is a common pursuit.

One vs Multiple bank accounts: What suits you best!

One cannot do without a bank account today. Find out how to decide if you need one or more based on your finances.

10 steps that can make a big difference in your budget

Having a fool-proof budget can get you on the right financial track. Use these 10 tips to keep your finances on track.

Building an Emergency Fund: Why It's Important & How to Start?

Life is full of surprises, and emergencies can happen when we least expect them. Whether it's a sudden medical expense, a car repair, or a job loss, having a financial safety net can make a world of difference.

7 Ways to Teach Financial Literacy to Children

In a world where financial decisions play a crucial role in shaping our lives, imparting financial literacy to children has become more important than ever.

How to set goals for effective budgeting !

ACTUAL INCOME = MONTHLY INCOME - (SAVINGS + EMI + TAXES + OTHER LIABILITIES LIKE INSURANCE PREMIUM, MEDICAL BILLS ETC.)

Credit bureaus and the role they play

Have you ever wondered what exactly a credit bureau does? This article will help you understand the role that credit bureaus play in an economy and the ways in which they can help you as a borrower.

Making the Right Financial Decisions Through Financial Literacy

In a world driven by constant change and economic uncertainties, the ability to make informed financial decisions is more crucial than ever.

Do you have everything you need to apply for a loan!

Are you planning to take a loan soon? But are you fully prepared to take the loan? Here’s a checklist you must read to make sure your loan application is processed and approved easily.

How To Keep Yourself Safe From Online KYC Scams?

In an era dominated by digital interactions, the convenience of online services comes with an inherent risk

What Your Lifestyle Reveals About Your Financial Future?

Have you ever wondered what your everyday choices say about your financial future? The way you live, spend, and save can give valuable clues about where your finances might be headed.

Things you should always check while borrowing money

Interest rate is what a loan company or bank charges for the loan amount they grant you. It is an important factor that determines the total cost of the loan.

7 Easy Ways to Control Overspending

Overspending can sneak up on anyone and put a dent in your wallet. But fear not, because managing your spending doesn't have to be complicated!

What is a Goal-based Investment & how should you do it?

When it comes to managing our finances, many of us are often unsure of where to begin. We may have dreams and aspirations, such as buying a house, funding our children's education, or retiring comfortably. However, without proper financial planning, these goals can remain distant dreams.

Tax Deductions vs. Exemptions – Differences & Examples

Understanding taxes can be a bit tricky, but it's crucial for managing your finances effectively.

What is Debt to Income Ratio and How is it Calculated?

Managing your finances wisely is essential for a secure financial future. One crucial aspect of financial health that often gets overlooked is the Debt-to-Income Ratio (DTI).

Top 10 Ways to Identify Personal Loan Scams Online

In a world driven by digital advancements, online personal loans have become increasingly popular in India.

Mantra 2 - Find ways to make extra money

Have you ever found yourself struggling to manage your finances while repaying your debts? If yes, you may have to do more than just cutting down on unnecessary expenses. In this article, you will find how Arvind helped Ravi find extra money to pay off his debts.

5 Signs You Need to Revise your Money Goals

Money goals are like a roadmap for your financial journey. They help you navigate through life, ensuring you reach your desired destination of financial stability and security.

Do you know the difference between good and bad debts!

This article will help readers differentiate between good and bad debts. It talks about the basic factors like cost, if the loan helps you build an asset, if it helps you secure your future, etc. that differentiate good debts from bad ones.

Heard of paying yourself first? – Here is why it is important

Paying yourself first ensures you always save money. Read on to understand more about what it is and how it can help you.

Tax Planning For Salaried Employees - How To Save More?

Tax planning is a crucial aspect of financial management for salaried employees.

6 Steps to Crafting the Perfect Money Management Plan

Managing your money wisely is like steering a ship through choppy waters – it requires planning, careful navigation, and a clear destination in mind.

How to plan for irregular and seasonal expenses

You may not forget about your monthly bills, but many of us often skip budgeting for occasional expenses. In this article, learn how Ravi, Riti, and Shruti found a way never to miss their irregular expenses.

Where to keep your savings!

We all have different saving goals. Here’s where you should keep your savings based on the duration and nature of your goals.

4 Investment Options to Start with This Festive Season

The festive season is not just a time for celebrations and joy; it's also an opportune moment to invest and grow your wealth.

Mantra 1 - Find money in your expenses

When you find yourself in a lot of debt, this first thing you should do is to reassess your budget. In this article, you will see how Ravi found money in his monthly expenses to repay some of his debts.

How smart is it to borrow from your friends and family!

Borrowing money from loved ones may seem convenient, but it can get complicated if you don’t treat them like any other loan. Here’s a list of things you must keep in mind while borrowing money from friends and family.

How can insurance help you deal with emergencies!

Having an insurance plan is like having a life jacket – you won’t know how useful it is unless you really need it. Read on to understand how the most common types of insurance plans can help you.

Setting smart financial goals

It’s not just about how much you save. It’s also about how S.M.A.R.T you save. Find out what they are for you and how you can save for them.

Did you know credit scores affect your job prospects besides future borrowing!

You may have heard about credit scores if you have applied for a loan. But most of you may not know about its impact on things apart from your borrowings. This piece can help you understand other such ways in which your credit score may affect you.

How to Secure Your Investments During Inflation?

As a moneymaker, you have worked hard to build your portfolio and want to see solid returns over time. However, during periods of high inflation your investments and returns can come under pressure.

4 Steps to Build Personal Financial Discipline

Understanding taxes can be a bit tricky, but it's crucial for managing your finances effectively.

How to Save Taxes Beyond Section 80C?

Wealth planning is essential for achieving financial security and prosperity. However, the road to build and preserve wealth is not without its share of risks. To ensure a successful journey, it is crucial to understand and effectively manage these risks. In this blog, we will explore the concept of risk management in wealth planning.

Different types of bank accounts

Not every type of bank account is right for everyone. Read this piece to find out which one you should choose based on their pros and cons.

Should you save or pay off your debt!

When your finances are tight, it can be difficult to decide whether you should save or repay debt. Use these tips to manage debt, save more, and learn how to prioritize them.

How to start saving money

This article talks about old and new ways of saving money. It also mentions quick tricks to save more from everyday expenses.

10 Effective Budgeting Strategies for Saving Money

Budgeting is a fundamental skill that empowers individuals to take control of their finances and work towards their financial goals. Creating a budget helps you track your income and expenses, identify areas where you can save money, and make informed financial decisions.

How can internet banking make your life easier!

This piece takes an example from the lives of Rita and Rohan to illustrate how internet banking has made various aspects of the banking experience extremely convenient.

Myths Vs Facts on savings Bank account

You might have heard many myths about bank accounts. Read this piece to dispel those notions and understand how you can benefit from having a savings bank account.

Why 77% of Working Professionals Rely on Personal Loans?

In today's fast-paced world, managing finances can be a daunting task for working professionals.

Saving Vs. Investing: What’s The Difference?

Do you ever find yourself confused about the difference between saving and investing? You're not alone! While both involve putting money aside for the future, they are two distinct financial strategies.

Common Mistakes to Avoid While Filing Income Tax Returns

You’re probably already aware of the need to file your income tax return (ITR) every financial year. But did you know that there are some common mistakes associated with filing ITRs? It’s important to be aware of these mistakes so that you can avoid them and make sure your ITR filing is accurate and effective.

Old vs New Tax Regime: Which is the Best Option for You?

Tax planning plays an important role in managing finances effectively. With the introduction of the new tax regime in India, taxpayers now have the option to choose between the old and new tax regimes based on their financial goals and circumstances.

5 Smart Tips For Easy Personal Loan Management

In today's world, personal loans have become an important financial tool to help individuals meet their financial goals. Be it organizing a wedding, buying a car or house, or even consolidating debt, personal loans can provide much-needed financial help.

How To Improve CIBIL Score In 30 Days?

Your CIBIL score is an important factor in finding out your creditworthiness and can affect your ability to obtain loans, credit cards, and other financial products. A low CIBIL score can lead to higher interest rates, which can be a burden on your finances.