Things you should always check while borrowing money

Nisha and Arvind are a young couple living in Delhi. Here is the story of a little but important incident from their life.

Nisha: I regret not listening to you. I think I was being impulsive and irrational by going for that 0% interest deal on the new fridge. I should have considered your advice.

Arvind: We did need a new fridge, but what is it that’s bothering you right now?

Nisha: Remember the bonus I got last week? I thought I’d use that to pay a few instalments at once, but I didn’t know that I’ll be charged a 5% early repayment fee for it.

Arvind: Was this mentioned in the summary shared by the loan company?

Nisha: I regret not checking it properly. I did not know there were so many extra charges and penalties! Ugh!

Arvind: What’s done is done. Let this be a lesson for the next time. It is very important to read every bit of the fine print.

Nisha: I’m not getting carried away again by these deceptive advertisements.

Listen, I have an idea. Why don’t you help my friends and I understand these factors the next time we have a kitty party?

Arvind: Of course, anything for you.

So, the next weekend when Nisha’s friends gathered at her house, Arvind was prepared to give them a small class on the important factors that one must consider when borrowing. Here’s how it went.

Arvind: Today, let’s discuss a few important points for you to keep in mind while taking a loan.

Let’s begin with the primary factors.

What will your loan cost you?

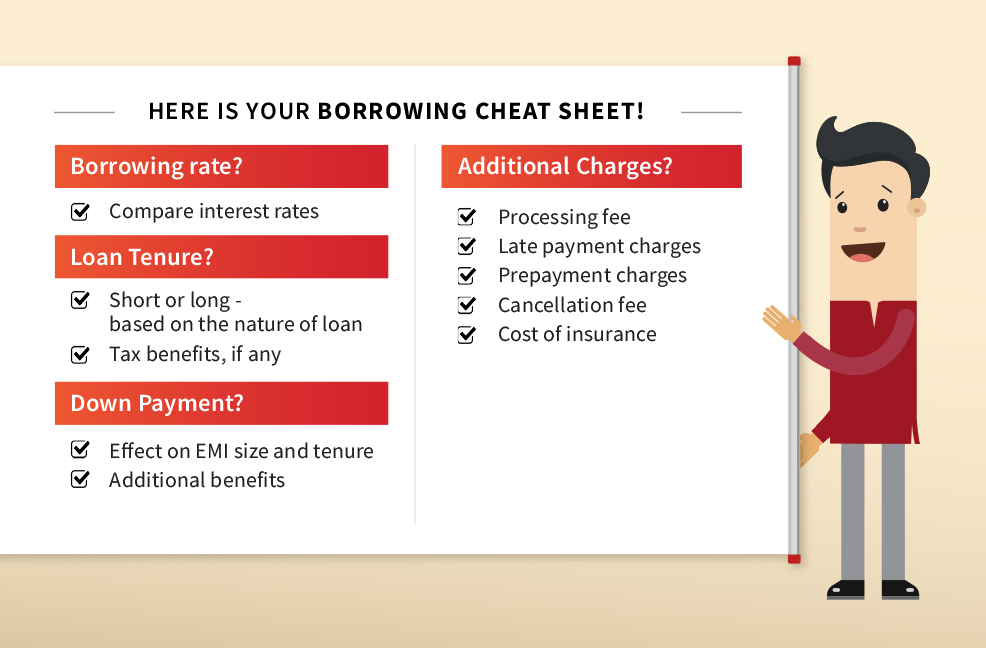

Factor 1 - Interest rate

Interest rate is what a loan company or bank charges for the loan amount they grant you. It is an important factor that determines the total cost of the loan.

Let's take an example:

Tell me which one would you choose?

Friends: The one with a 12% rate of interest, of course.

Arvind: That’s what any normal person would choose. But that gives us the first rule.

Don’t be deceived by a low-interest rate considered in the absence of other factors.

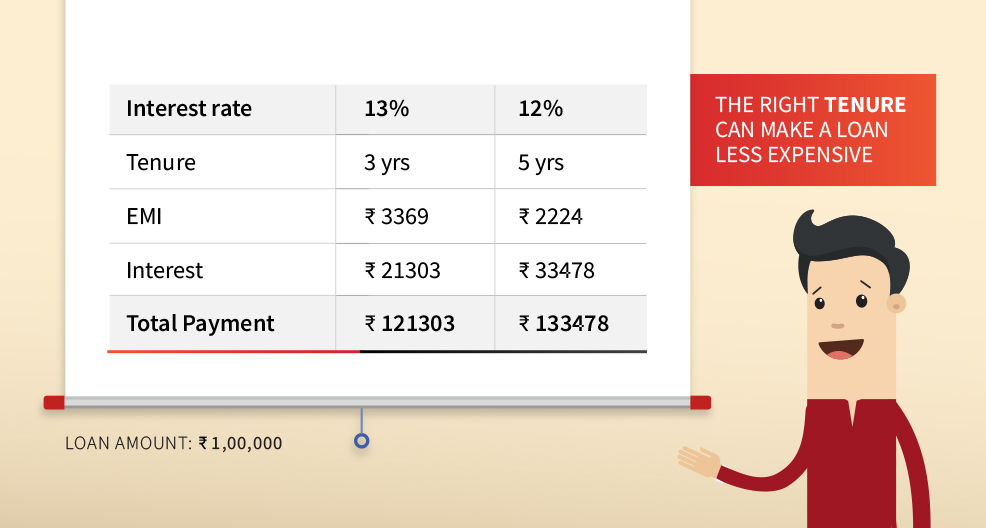

Factor 2 – Loan term

A loan term is the number of months or years you decide to pay back a loan in.

Look at the scenario below. What do you see?

Friend 1: This so deceptive. The low-interest loan is more expensive!

Arvind: Low EMI sounds tempting like it did to Nisha. This means that you won’t just take longer to pay off the loan but pay more interest over that time.

What’s more, if you check the remaining amount after paying a few EMIs, you may realise that a large portion of the principal amount is still due. Loan companies or banks do so to manage the risk. In the beginning principal amount on which interest is charged is larger, so interest earned by the lender is higher.

Friend 2: Oh, so this is the reason why my outstanding car loan amount looked so high when I checked after paying EMIs for six months. These lenders sure are clever.

Arvind: It is important to choose the highest EMI amount you can comfortably pay according to your monthly income without disturbing your emergency funds and savings so that you pay the loan in the shortest term possible.

However, the term should be proportionate to the purpose of borrowing and whether you get some tax benefit on the same.

For example, a home loan or mortgage loan is high ticket size loan, generally with a term of 10-20 years which also gets you some tax benefits. On the other hand, a credit card, despite being payable in 6-12 months, has high-interest rates and no tax benefits.

Choose the right term and EMI to minimise interest cost.

Factor 3 – Down payment

Most loan companies or banks ask you to pay a certain amount of the cost of commodity upfront and finance the remaining amount. More the down payment, lesser the amount loaned, and thus, smaller EMIs paid over a shorter tenure.

Friend 2: I remember this discussion with my husband when we were buying a car. We argued so much.

Arvind: Interesting! So, what was the discussion about?

Friend 2: We took a Maruti Baleno on loan. I insisted on paying only Rs. 1,00,000 and make an EMI of 10,000 for 48 months, and he suggested that we pay Rs. 2,00,000 upfront and make an EMI of 10,000 for 30 months.

Arvind: Who won?

Friend 2: He did, of course. We did have to break a Fixed Deposit to make a larger down payment which didn't make sense to me.

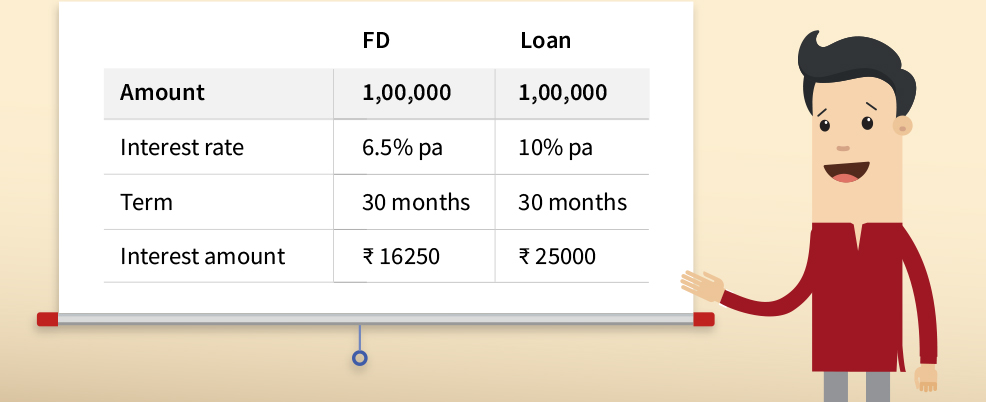

Arvind: Let's discuss this for a minute. How much interest was your bank giving on the FD?

Friend 2: 6.5%

Arvind: The interest on your car loan is?

Friend 2: 10%

Let’s do a simple calculation on this additional Rs. 1,00,000 that was spent as down-payment.

So, in 30 months, you earn lesser on the FD than what you would pay on the car loan. That means making a larger down payment saved you some money by reducing the EMI and tenure.

Maximise your down payment for loans with more interest rate to make them less expensive.

Friend 3: Three simple points. These are easy to remember.

Arvind: Not so fast. There are other charges that can make loans more expensive.

What can make a loan more expensive?

1. Application/Processing fees

Some lenders charge an application or processing fee, which is paid once at the time of loan sanctioning or as part of your monthly instalments. In most cases, this is not refundable.

2. Missed or late payment charges

You may not have known this but missing an EMI can incur some late fee. In some cases, you may get a grace period, within which you can pay the instalment to avoid such penalties. This is one of the reasons why it is important to make sure you’ll be able to afford a loan before you take one, as such charges can increase the borrowing burden.

3. Pre-payment charges/Foreclosure charges

If you had ever tried paying back a loan before its tenure ended, you might have incurred an early payment penalty.

Now, you may wonder why a lender wouldn’t want their money back before time. That is because they would normally earn interest over a loan tenure. If you make an early payment, it reduces the tenure and lender's earnings from interest. So, to discourage early repayments and recover loss of income, they may charge this early repayment fee.

4. Cancellation fee

Like the above charges, cancelling a loan may also involve a fee or charge.

Some lenders allow a certain cooling period like 15 to 30 days post granting the loan, during which if you cancel a loan, you won’t be charged additionally for it.

So, ask your lender if they offer the free trial period and the rate at which they charge cancellation fees if any.

5. Insurance premium

Your lender may ask you to insure your loan to mitigate risk. It is optional, but I recommend you to insure long term loans like a car loan, personal loan or home loan, as it gives you a cushion during unforeseen events. It also increases lender security, so they may try to sell it to you without your knowledge. Paying EMIs on time can prevent additional charges from making your loan more expensive, besides building a good credit score.

Beware of signing documents without reading and understanding the terms and costs of the service.

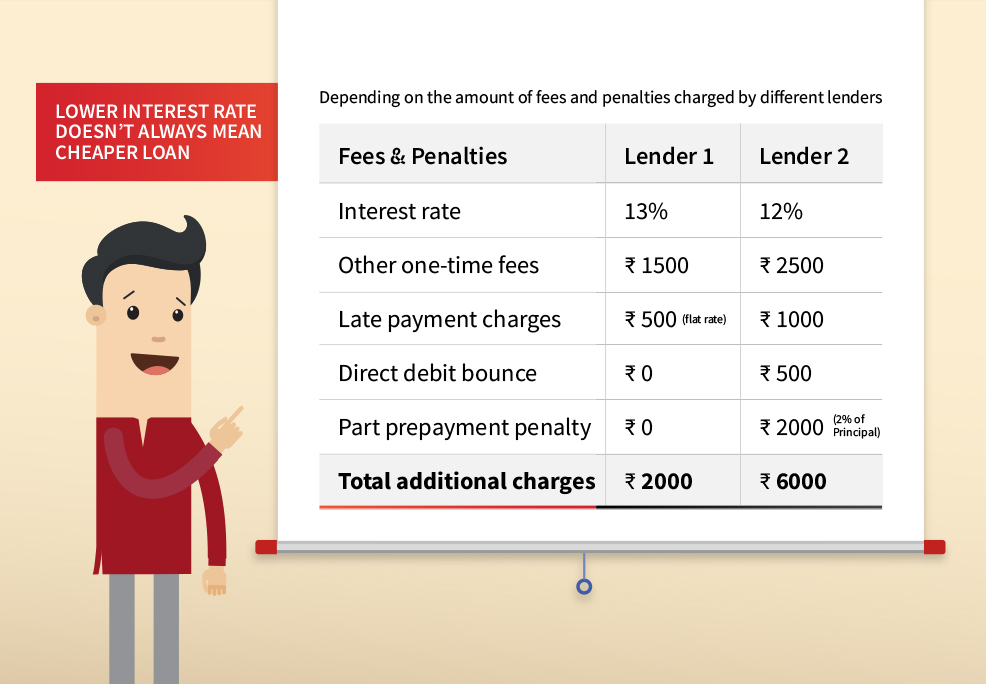

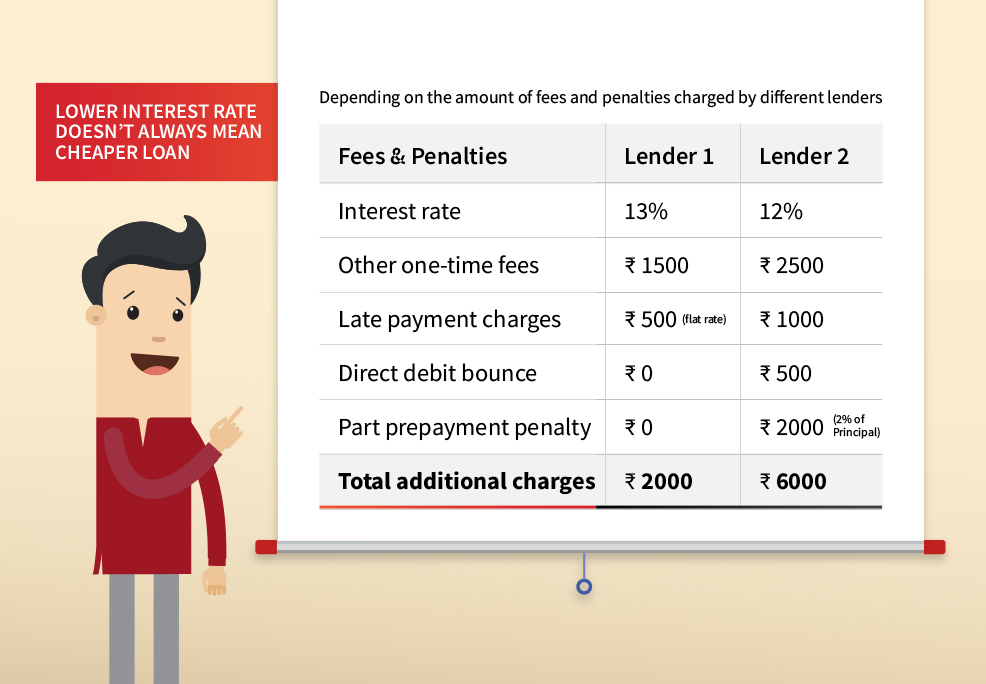

So, when you choose the loan with a 12% interest rate, you end up paying more than the loan with 13% interest due to additional charges.

Friend 4: I didn’t realise how these charges could make a loan with a lower interest rate much more expensive!

Always check what penalties and fees you are being charged

Arvind: I think this is enough for today. But tell me, what have you all learnt out of all this?

Friend 5: If we don’t ask the right questions, we may end up wasting our hard-earned money!

Arvind: That’s correct!

Have I earned a great cup of coffee and my favourite samosas now?

Nisha: Of course, my smart husband!

Take the quiz Do you know the right types of loans for your needs? to test your knowledge about loans.

Related Topics

- Managing Debts

Making the Right Financial Decisions Through Financial Literacy

In a world driven by constant change and economic uncertainties, the ability to make informed financial decisions is more crucial than ever.

- Managing Debts

How To Keep Yourself Safe From Online KYC Scams?

In an era dominated by digital interactions, the convenience of online services comes with an inherent risk

- Managing Debts

Why 77% of Working Professionals Rely on Personal Loans?

In today's fast-paced world, managing finances can be a daunting task for working professionals.

- Managing Debts

How to Choose Your Ideal Repayment Tenure for Personal Loans?

Personal loans have become an indispensable financial tool for many individuals, offering a quick and convenient way to address various financial needs.

- Managing Debts

Top 10 Ways to Identify Personal Loan Scams Online

In a world driven by digital advancements, online personal loans have become increasingly popular in India.

- Managing Debts

What is Repo Rate? How Does it Affect the Economy?

Have you ever heard the term "repo rate" and wondered what it's all about? Well, you're not alone.

- Managing Debts

What is Debt to Income Ratio and How is it Calculated?

Managing your finances wisely is essential for a secure financial future. One crucial aspect of financial health that often gets overlooked is the Debt-to-Income Ratio (DTI).

- Managing Debts

Things to Tell Your Child When They Apply for Their First Personal Loan

As your child ventures into adulthood, they will face various financial milestones, one of which may be applying for their first personal loan.

- Managing Debts

How Can a Personal Loan Be Used as an Investment?

In today's fast-paced world, financial goals and dreams are many. Whether it's pursuing higher education, starting a small business, or renovating your home, we all have aspirations that require financial support.

- Managing Debts

5 Smart Tips For Easy Personal Loan Management

In today's world, personal loans have become an important financial tool to help individuals meet their financial goals. Be it organizing a wedding, buying a car or house, or even consolidating debt, personal loans can provide much-needed financial help.

- Managing Debts

Did you know credit scores affect your job prospects besides future borrowing!

You may have heard about credit scores if you have applied for a loan. But most of you may not know about its impact on things apart from your borrowings. This piece can help you understand other such ways in which your credit score may affect you.

- Managing Debts

Could your decision to take another loan make you regret later!

Have you ever made an impulsive purchase and regretted later? Or fell into the trap of a promotional offer? This article tells you the important questions that you must ask before deciding to borrow money for anything.

- Managing Debts

Do you have everything you need to apply for a loan!

Are you planning to take a loan soon? But are you fully prepared to take the loan? Here’s a checklist you must read to make sure your loan application is processed and approved easily.

- Managing Debts

What is a budget? Why is it so important!

Budgeting is the solution of most financial problems. In this listicle, learn about what budgeting is and its many benefits.

- Managing Debts

Heard of paying yourself first? – Here is why it is important

Paying yourself first ensures you always save money. Read on to understand more about what it is and how it can help you.