7 Budgeting pitfalls that can push your finances off track

A budget is the most useful tool to help you manage your money wisely. But just creating one will not solve your problems; a budget should be followed with discipline. It takes time and effort to perfect a budget, and to ensure you achieve your goals sooner, avoid the following common budgeting blunders that may hinder your progress:

Watch Budget: Your means to achieve the dream lifestyle to know how budgeting can help you.

1. Budgeting on assumptions

Budgeting based on assumptions or an inaccurate assessment of your finances – such as overestimating your income or underestimating your expenses – will lead to you spending more than you earn.

Timeless advice: If you earn bonuses or incentives in addition to a monthly salary, you cannot just divide it by 12 and add to your monthly incomes. These should be added as additional funds of months in which these are earned and can be used to fulfil financial goals or repay debts sooner.

2. Creating a budget that’s too tight

Budgeting for every single rupee you earn can cause you to overshoot your budget when expenses fluctuate, or a sudden need arises. You may have to dig into your savings or borrow to take care of fluctuating expenses like high utility bills, unexpected visitors, rise in prices due to inflation, etc.

Timeless advice: Keep a buffer in your budget to cover small fluctuation in expenses. If you are still left with that extra amount at the end of the month, add it to your emergency fund to cover for expenses during unforeseen situations like a job loss or serious illness.

3. Not tracking and recording expenses

Your budget will remain an excel activity if you don’t track where your money is going. You need to collect receipts of your purchases. You also need to save transaction details of all online payments. Only then can you accurately know how much you are spending on each category of expenses so that you can avoid exceeding the set limit.

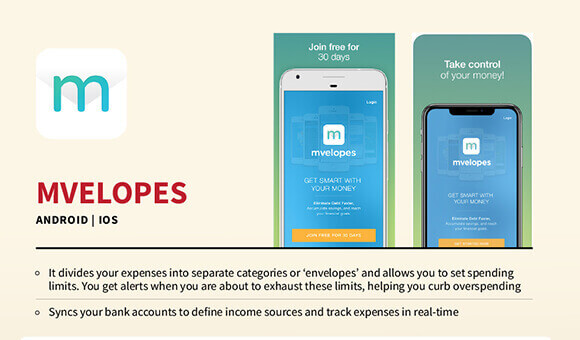

Timeless advice: Try a budgeting app for easier money management.

4. Spending before saving

If you don’t set a fixed amount in your budget as savings, you are robbing your future self. Your goals may remain as just wishes, or you may end up borrowing to achieve them, leading to debt-related stress.

Timeless advice: Keep a separate bank account for your savings and add a fixed amount at the beginning of each month in it for your short-, mid-, and long-term goals.

5. Not revising your budget regularly

If you don’t re-adjust your budget based on changes in your income and expenses, you will either end up spending more or saving less than you should. If you get a raise or move to a smaller apartment, it should reflect in your budget.

Timeless advice: Every time you achieve a goal, your budget should be re-adjusted to fund your next goal. Depending on the amount required to achieve that goal, you may have to cut down on some unnecessary expenses.

6. Ignoring the small spends

Spending Rs. 50 on coffee or Rs. 200 on a cab ride every other day may not seem like much but can add up to thousands of rupees in the long run. Make sure you budget for these spends.

Timeless advice: Be honest with yourself and include even the smallest expenses in your budget.

7. Spending impulsively

The primary aim of budgeting is to plan your expenses in advance, but if you keep spending impulsively, your budget will fail to keep your finances on track.

Timeless advice: Budget using the ‘Envelope Method’ – set aside a fixed amount for each expense category in labelled envelopes. Label one envelope as “Me money” and keep some amount in it to spend on anything you wish to.

Go here for tips to make a budget that works.

Now let’s look at how Seema and Uday fixed the pitfalls in their budgets:

Seema’s story

Seema Singh is smart, modern, and single. She has a well-paid job at an advertising company and was used to living lavishly until she had a road accident. She had no health insurance, so the cost of hospitalisation, medical tests, and medicines forced her to take a high-interest personal loan. This landed her in a debt trap as she already had a large amount of credit card dues and an auto loan. She was bed-ridden for three months, so once she exhausted her paid leaves, she received a reduced salary for the next two months. This made it harder for her to manage her expenses.

From following a loose budget, Seema switched to a budget using the ‘Envelope Method’. To be able to repay all the loans along with monthly expenses, Seema had to make some drastic cuts in her spending. She stopped going out for meals with her friends for the next year. During her recovery period at home, she collected all her unused clothes and accessories to sell them at her friend’s garage sale. She started an emergency fund with this extra money to which she added 10% of her income every month.

Seema set three goals – repaying her loans, building an emergency fund, and getting medical insurance.

Uday’s story

Uday Jha is a freelance press photographer with almost three years of experience. He started his career with a one-year contract with an international magazine that paid him well. Once that contract was over, he started working independently. Sometimes he received large assignments that easily took care of four-five months of his expenses. When he did not get such assignments, he had to resort to borrowing from friends and exhausting his credit cards.

A turning point in his life came when his aged father had to sell his mother’s gold jewellery to buy a tractor that Uday could not pay for. That’s when his friend Arvind helped him create a ‘bare-bones budget’ that only included the most basic necessities like rent, groceries, utility bills, EMIs and credit card bills, etc. Arvind advised him to use the 70:30 ratio to divide his income – 30% as savings and 70% to cover for basic monthly expenses. With Arvind as his budget’s ‘goal-keeper’, Uday was able to repay his debts within a year and started building an emergency fund and savings corpus for his future goals.

Remember, if you keep making the mistake of prioritising small, short-term wants over bigger, long-term gains, you will move farther away from your goals. Budgeting allows you to gain financial independence and live a happy, stress-free life by enabling us to live within our means.

Related Topics

- Managing Money

Jaanniye Aasaan Tareeke EMI Ka Bhugtan Minton Mein Karne Ke!

Jaanniye Aasaan Tareeke EMI Ka Bhugtan Minton Mein Karne Ke!

- Managing Money

Which Saving Schemes Are The Best To Invest?

Saving money is a crucial aspect of financial planning, and choosing the right saving schemes can significantly impact your wealth accumulation.

- Managing Money

Boost Your Income With 3 Best Investment Plans

In a dynamic and ever-changing economic landscape, the quest for financial stability and growth is a common pursuit.

- Managing Money

Tax Planning For Salaried Employees - How To Save More?

Tax planning is a crucial aspect of financial management for salaried employees.

- Managing Money

Budget Planning Tips For A Better Financial Future

In a world marked by economic uncertainties and rapidly changing financial landscapes, effective budget planning is the cornerstone of a secure and prosperous future.

- Managing Money

Ways to Get in Better Financial Shape in 2024

As we step into a new year, many of us are eager to make positive changes in our lives, and one area that often takes center stage is our finances.

- Managing Money

How Can Personal Loans Help You Achieve Financial Independence?

In a world where financial goals often seem elusive, personal loans emerge as versatile tools that can empower individuals on their journey towards financial independence.

- Managing Money

How Personal Loan Apps Are Leading To A Financially Healthy India?

In recent years, the landscape of personal finance in India has undergone a transformative shift, thanks to the emergence of innovative financial technologies.

- Managing Money

How to Set Personal Finance Goals?

In the pursuit of financial stability and success, setting clear and achievable personal finance goals is a crucial step.

- Managing Money

6 Steps to Crafting the Perfect Money Management Plan

Managing your money wisely is like steering a ship through choppy waters – it requires planning, careful navigation, and a clear destination in mind.

- Managing Money

4 Steps to Build Personal Financial Discipline

Understanding taxes can be a bit tricky, but it's crucial for managing your finances effectively.

- Managing Money

5 Tips to Spend Less & Save More this Festive Season

The festive season is a time of joy, celebration, and togetherness.

- Managing Money

4 Investment Options to Start with This Festive Season

The festive season is not just a time for celebrations and joy; it's also an opportune moment to invest and grow your wealth.

- Managing Money

Financial Lessons To Learn From the Holiday Season

The holiday season is a time of joy, celebration, and spending time with loved ones.

- Managing Money

How to Set S.M.A.R.T Financial Goals?

In today's fast-paced world, setting financial goals is crucial to secure a stable future.

- Managing Money

Tax Deductions vs. Exemptions – Differences & Examples

Understanding taxes can be a bit tricky, but it's crucial for managing your finances effectively.

- Managing Money

5 Signs You Need to Revise your Money Goals

Money goals are like a roadmap for your financial journey. They help you navigate through life, ensuring you reach your desired destination of financial stability and security.

- Managing Money

7 Best Investments Options in India

Are you thinking about making your money work for you? Investing is a smart way to grow your savings over time.

- Managing Money

7 Ways to Teach Financial Literacy to Children

In a world where financial decisions play a crucial role in shaping our lives, imparting financial literacy to children has become more important than ever.

- Managing Money

What Your Lifestyle Reveals About Your Financial Future?

Have you ever wondered what your everyday choices say about your financial future? The way you live, spend, and save can give valuable clues about where your finances might be headed.

- Managing Money

7 Easy Ways to Control Overspending

Overspending can sneak up on anyone and put a dent in your wallet. But fear not, because managing your spending doesn't have to be complicated!

- Managing Money

How to Save Taxes Beyond Section 80C?

Wealth planning is essential for achieving financial security and prosperity. However, the road to build and preserve wealth is not without its share of risks. To ensure a successful journey, it is crucial to understand and effectively manage these risks. In this blog, we will explore the concept of risk management in wealth planning.

- Managing Money

Understanding Risk Management in Wealth Planning

Wealth planning is essential for achieving financial security and prosperity. However, the road to build and preserve wealth is not without its share of risks. To ensure a successful journey, it is crucial to understand and effectively manage these risks. In this blog, we will explore the concept of risk management in wealth planning.

- Managing Money

4 Most Common Types of Dividend Policies

When investing in the stock market, one of the most attractive aspects for investors is the potential to receive dividends. A dividend is a portion of a company's profits that is distributed to its shareholders. However, not all companies follow the same approach when it comes to distributing dividends.

- Managing Money

Long-term vs. Short-term Investments: Pros and Cons

When it comes to investing your hard-earned money, it's important to have a clear strategy in mind. Two common approaches are long-term and short-term investments.

- Managing Money

10 Effective Budgeting Strategies for Saving Money

Budgeting is a fundamental skill that empowers individuals to take control of their finances and work towards their financial goals. Creating a budget helps you track your income and expenses, identify areas where you can save money, and make informed financial decisions.

- Managing Money

Investing Wisely: Tips for Growing Your Wealth

Building wealth is a goal shared by many, but it can often seem like a complex and overwhelming task. However, with a few simple strategies and a basic understanding of investing, you can set yourself on the path to financial success.

- Managing Money

Building an Emergency Fund: Why It's Important & How to Start?

Life is full of surprises, and emergencies can happen when we least expect them. Whether it's a sudden medical expense, a car repair, or a job loss, having a financial safety net can make a world of difference.

- Managing Money

What is a Goal-based Investment & how should you do it?

When it comes to managing our finances, many of us are often unsure of where to begin. We may have dreams and aspirations, such as buying a house, funding our children's education, or retiring comfortably. However, without proper financial planning, these goals can remain distant dreams.

- Managing Money

How to Secure Your Investments During Inflation?

As a moneymaker, you have worked hard to build your portfolio and want to see solid returns over time. However, during periods of high inflation your investments and returns can come under pressure.

- Managing Money

How to Use 80C Deductions to Reduce Your Tax Burden?

Ever feel like you're paying too much in taxes each year? You're not alone. As a salaried employee, a huge chunk of your income goes towards taxes. But here's the good news: there are legal ways to reduce your tax burden. Section 80C of the Income Tax Act 1961 allows you to claim deductions on select investments and expenses.

- Managing Money

Common Mistakes to Avoid While Filing Income Tax Returns

You’re probably already aware of the need to file your income tax return (ITR) every financial year. But did you know that there are some common mistakes associated with filing ITRs? It’s important to be aware of these mistakes so that you can avoid them and make sure your ITR filing is accurate and effective.

- Managing Money

Old vs New Tax Regime: Which is the Best Option for You?

Tax planning plays an important role in managing finances effectively. With the introduction of the new tax regime in India, taxpayers now have the option to choose between the old and new tax regimes based on their financial goals and circumstances.

- Managing Money

Saving Vs. Investing: What’s The Difference?

Do you ever find yourself confused about the difference between saving and investing? You're not alone! While both involve putting money aside for the future, they are two distinct financial strategies.

- Managing Money

Where can you find extra funds to save!

Every small drop makes an ocean. Similarly, every rupee you save could come to use in the future. In this article, we offer you ways to save money in the most unlikely of ways.

- Managing Money

Setting smart financial goals

It’s not just about how much you save. It’s also about how S.M.A.R.T you save. Find out what they are for you and how you can save for them.

- Managing Money

Right time to start saving: In your 20s or 30s!

This infographic shows when you should start saving and why through Aisha and Riya’s stories.

- Managing Money

Why is it important to have an emergency fund, How can you build one!

An emergency fund can provide a cushion in various situations. Read on to understand why you need it, and how you can build one.

- Managing Money

Where to park your emergency savings!

While emergency funds are meant to be easily accessible, that doesn’t mean you should store it all in cash. Instead, follow these tips to keep them secure yet accessible.

- Managing Money

How to start saving money

This article talks about old and new ways of saving money. It also mentions quick tricks to save more from everyday expenses.

- Managing Money

How to figure out how much to save in an emergency fund!

If you want to save but don’t know how much to, read this infographic to choose a method that suits you best from three easy options.

- Managing Money

Are you overestimating your income when budgeting!

Overestimating income is a more common mistake that you would think. In this article, we give you step-by-step guides to avoid spending with the assumption of having more money.

- Managing Money

How important is it to have medical insurance!

Sameer understood the importance of having medical insurance only after getting into an accident. Here’s what you can learn from his experience.

- Managing Money

How to keep your money safe from yourself!

Make your budget water-tight by using these tips to keep yourself from misspending your money.

- Managing Money

Teach your kids the whys and hows of money management

Responsible children grow up to be wise adults. Give your children the tools to become financially successful in the future with these tips.

- Managing Money

Know where all your money is going before you start budgeting

Vidhi complains to Arvind that despite budgeting as he had suggested, she still isn’t saving enough. Read this comic strip to know why and how Arvind helped her find a way to save thousands of rupees!

- Managing Money

Why should I save money when getting loans is so easy!

While taking a loan might be an easy option, it’s not advisable to borrow unnecessarily. Learn more about benefits of saving regularly and consistently.

- Managing Money

10 steps that can make a big difference in your budget

Having a fool-proof budget can get you on the right financial track. Use these 10 tips to keep your finances on track.

- Managing Money

How can you protect your family with life insurance!

Sahu ji is worried about his family’s wellbeing but doesn’t have a life insurance plan yet. Arvind helps him understand why it is important to get one.

- Managing Money

9 modern ways to save money

ONLY KEEP AS MUCH CASH AS YOU NEED This will help you reduce impulsive spending and stay aware of every rupee you spend

- Managing Money

8 budgeting apps that can make money management easier

GET SMART WITH YOUR MONEY MVELOPES. It divides your expenses into separate categories or 'envelopes' and allows you to set spending limits.

- Managing Money

How can insurance help you deal with emergencies!

Having an insurance plan is like having a life jacket – you won’t know how useful it is unless you really need it. Read on to understand how the most common types of insurance plans can help you.

- Managing Money

Questions you didn't know whom to ask about budgeting

Do you want to start budgeting but don’t understand how? We’ve answered budgeting FAQs that can help you kickstart your journey.