Mantra 1 - Find money in your expenses

Ravi had been worried about his increasing debts, and Arvind suggested a 5-mantra plan to start his journey out of it. Arvind and Ravi met, just as they had decided earlier to discuss the first mantra, which is “Find money in your expenses”.

Find out Ravi's full story in the previous article Is your debt controlling you? Read to know.

Ever since their chat in the badminton court, Ravi had been looking forward to meeting Arvind again. He wanted to get out of debt as soon as possible, and he knew if anybody could help him, it’s Arvind. Like they had decided, they met again, and Arvind could clearly see the urgency on Ravi’s face as he took long drags of a cigarette.

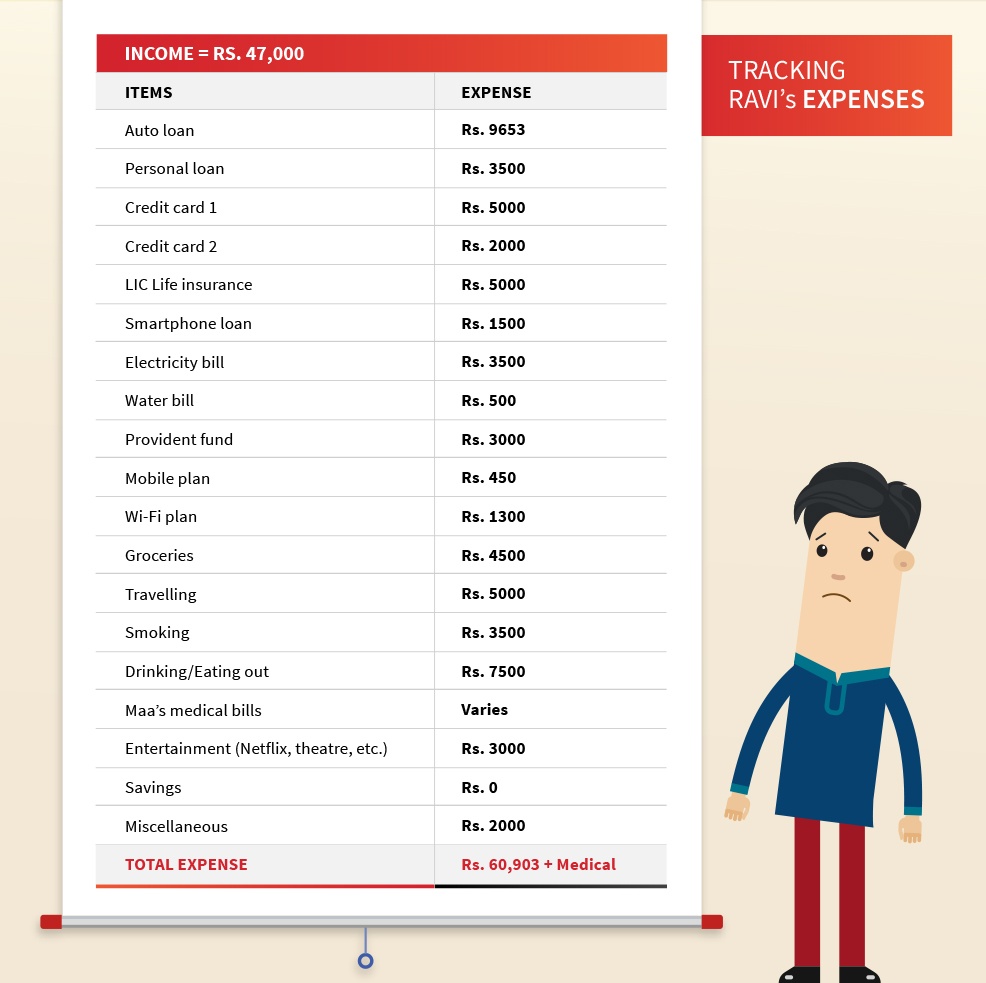

“Hey, Ravi, ready for an honest look at your expenses? The first thing you need to do is see if your expenses are exceeding your income. You have an MBA degree and work at a multinational company, so I’m sure you earn well. Toh vo kahan kharch hote hain?” Arvind asked curiously.

“I don’t know yaar. Mai to kahin bhi extra spend nai karta. Just groceries, utilities, travelling wagairah. Lately, I’ve been paying for Maa’s treatment and medicines as well.” Ravi took a pause and continued “And sometimes I go out with my friends, but that’s all. I think buying that car was a mistake.”

“Hmm… Okay, tell me something, Ravi. How many cigarettes do you smoke in a day? And how many times do you go out for drinks in a week?”

“Around 6-7 cigarettes in a day. I’ve been really stressed ever since Maa’s diagnosis. And I only go out on weekends” said Ravi while looking down at his badminton racquet.

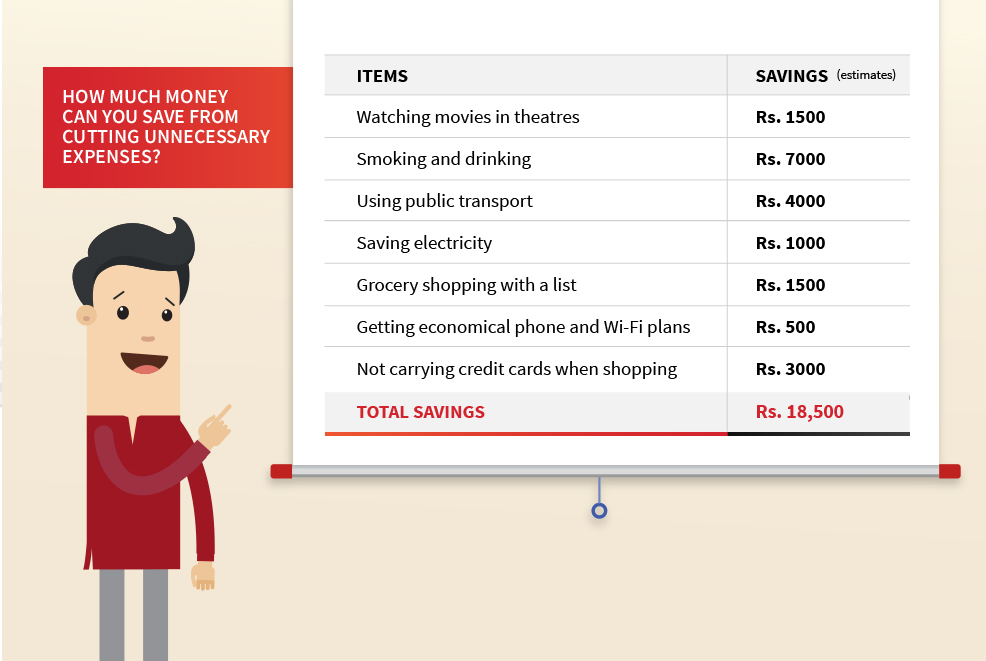

“Ravi,” said Arvind calmly, “this is adding to your problems. There are these small, often unnecessary expenses that go unnoticed but add up to a lot. For example, you are spending about Rs 3500 on just cigarettes in a month. You could pay a loan EMI with that money or more than the minimum payment on your credit card. And anyway it's bad for your health. Even something as small as grocery shopping with a list or eating before going to the mall can help you save money because you end up spending more when you go out on an empty stomach.”

“I never thought about that”, said Ravi surprised. “If I started meeting friends at home instead of always going out, I could save money there as well.”

“Exactly. Remember how we would identify the problem areas before exams and then focus more on them? You need to do exactly that. Track your expenses, identify the areas where you can make small adjustments and put that money towards repaying your debt. ” Arvind said.

Arvind patted him on the back and continued, “Your expenses are clearly exceeding your income. I think you need to go on a ‘spending fast’ where you sacrifice leisure till your monetary situation is back in control. Let's look at how much money this can save”.

"The best place to find money is in your expenses."

Ravi looked up at Arvind, “Okay, this is really eye-opening, but uskey baad kya?”

Arvind smiled and said, “Once you know what and what not to spend on, make a budget and commit to it.

"Where there is will, there is a way"

A common mistake most people make is not keeping savings and loan repayment at the top of their budget. Set aside your savings and EMI amounts at the beginning of each month. You can set automatic debits so that you don’t miss any payments. This way you will learn to manage other expenses with whatever is left.

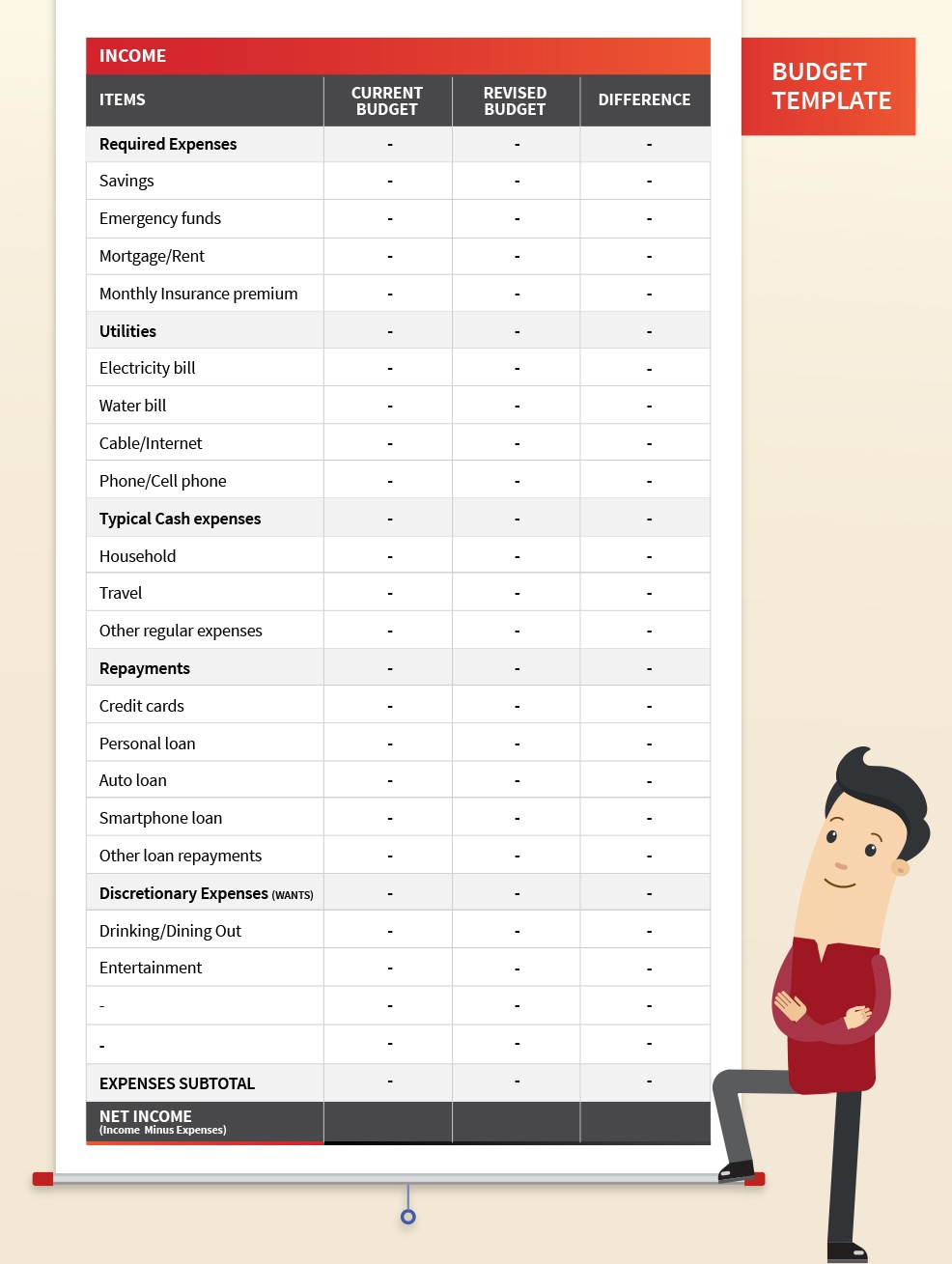

I am sharing a budget template with you that is easy to use.

As Ravi starts thinking, Arvind tells him they will meet again when he has a budget ready and leaves him to work on it.

Find out what Arvind told Ravi next in Mantra 2 - Find ways to make extra money.

Related Topics

- Borrowing and credit basics

5 Ways to Protect Yourself from Financial Fraud

In today's digital age, financial fraud is becoming increasingly common. Scammers are constantly devising new ways to trick unsuspecting individuals into revealing their personal information or making fraudulent transactions.

- Borrowing and credit basics

Do you know the difference between good and bad debts!

This article will help readers differentiate between good and bad debts. It talks about the basic factors like cost, if the loan helps you build an asset, if it helps you secure your future, etc. that differentiate good debts from bad ones.

- Borrowing and credit basics

6 Crucial Debt Management Tips to Learn & Apply In 2025

Are you struggling with managing your debt? You're not alone. Many people face challenges when it comes to debt management. However, with a few tips, you can learn to manage your debts effectively. In this blog post, we will discuss six important debt management tips that you can learn and apply in 2025.

- Borrowing and credit basics

Talk to the loan company for help

This is the last piece of the mantras series. In this piece, Arvind talks about the various ways your loan company can help in case of default. It suggests steps like contacting your lender asap and informing them about the reason for the delay, sharing your previous repayment history with them, etc. and informs you of the ways your loan company can help you deal with your debt. Then he informs Ravi about some ways his lender can help his deal with his debts.

- Borrowing and credit basics

Choose a systematic method to pay your debt

Arvind and Ravi are halfway through their 5 mantra plan and are meeting to discuss the third mantra - Adopt a method to pay debt systematically. Arvind helps Ravi chart out a workable method, which is best suited to his situation to pay off his debts.

- Borrowing and credit basics

Mantra 4 - Dig into your long-term savings to secure your today

You save money to secure your future, but your present may need it more at times. Particularly when dealing with excessive debt, savings and investments can help you repay them sooner. Find out how Arvind helped Ravi identify sources of extra money to clear his debts.

- Borrowing and credit basics

Mantra 2 - Find ways to make extra money

Have you ever found yourself struggling to manage your finances while repaying your debts? If yes, you may have to do more than just cutting down on unnecessary expenses. In this article, you will find how Arvind helped Ravi find extra money to pay off his debts.

- Borrowing and credit basics

Is your debt controlling you? Read this to know

Debts can either help you achieve life goals sooner or pull you farther away from them. Ravi was struggling with his loans too, but Arvind told him about these 5 mantras that will help him get out of debt.

- Borrowing and credit basics

How much debt is too much

We all need to borrow money at some point in our lives. But it is very important to know when to stop and reassess our finances. This article mentions indicators that can tell you if you have more debt than you can comfortably repay.