Do you know the difference between good and bad debts!

Riya, Samrat, and Rohit are three childhood friends who live in Arvind’s society. Riya has been working as a law researcher for the past one year while Samrat was hired as a writer for a lifestyle magazine right after he completed his graduation. Rohit, on the other hand, decided to intern at a marketing firm for six months before applying for an MBA degree. While relaxing in the park, an argument broke out about whether they should go for a trip or not, and as is in the case of most first jobbers, money was the main concern. But lucky for them, they saw Arvind jog past them, who by now had a reputation as the financial expert of the society.

“Arvind bhayya, please tell Rohit that credit cards are completely safe to use.”, said Samrat.

“They kind of are” suggested Arvind, “but that completely depends on the situation. What’s the matter?”

“We’ve been planning this trip to Goa for almost six months now. We decided that when we are done with our commitments and have a week or two off, we’ll take a break. Riya and Samrat have saved up for the trip, but I wasn’t getting paid much at the internship, so I can’t go with them. On top of that, I should also save for my MBA fees.” answered Rohit.

“Yeah, but I’m telling you I can buy your tickets with my credit card.”, said Samrat. “It’s really not a problem. You pay me back whenever you can.”

“Okay, I see the problem here.”, said Arvind. “Well, depending on your situation, it could be both good or bad debt.

“Good and bad debts? What do you mean?”

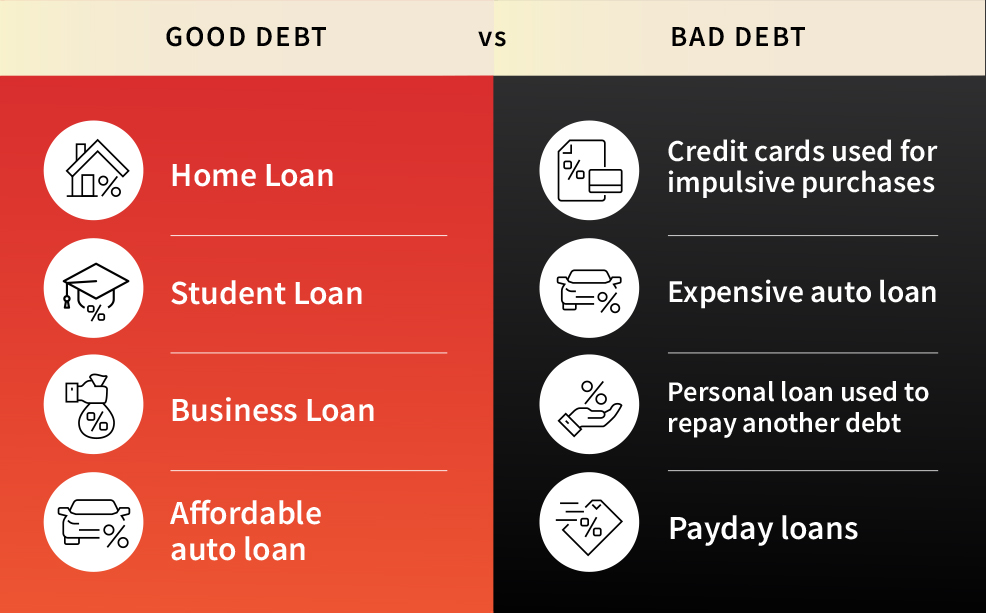

“Loans themselves are not inherently good or bad. It’s how we use them that determines if they help or harm us.

For instance, taking an education loan for Rohit’s MBA is good debt as it will help him acquire skills and increase his chances of getting a better job. The best part is that you can start repaying the loan once you’ve secured a job.

On the other hand, credit cards come with very high interest rates. Funding a vacation on credit makes it more expensive if you only pay the minimum balance due each month. Credit cards are great for emergencies, but only if you pay the full balance every time.

But Rohit will only be able to repay you over a few months. This may strain your finances and friendship."

“I think I understand what you mean. A loan that helps in the long run in good, right?” said Riya.

“That’s one way of looking at it.” said Arvind “If you are ever confused, here are some questions you should ask yourself to know if a debt is good or bad:

Does it help you save money?

Take Riya, for example. She bought a scooty recently, which is a good investment because otherwise, she had to take cabs or two buses every day to her workplace. She will not just save a lot of time, effort, and money in the long run, but this will also help her be more efficient at work due to less exhaustion.

If there was a cheaper way to travel available, like a direct metro, borrowing money to buy this scooty could be a bad debt for her.” Arvind explained.

Does it help you earn money?

If taking a debt, like Rohit’s student loan, increases your income eventually, it is considered good. Similarly, a mortgage or home loan is considered good debt as a house would appreciate in value and help build equity. If you earn rent on it, it can more than pay for itself and even earn you some profit. You may also get tax benefits, making it a good investment.

Does it increase your net worth?

Loans, like home loan, student loan, and business loan, are considered good as they help you increase your net worth. We know that Samrat aims to start his own business one day. Now, if he takes a loan to establish or expand his business, it would be considered good debt as it will help him become financially more stable.

As opposed to this, impulsively borrowing money adds additional burden to your finances, and does not help you achieve any long-term goals. Ideally, we should save up and spend on things like vacations, luxury items, entertainment, etc.

Rohit, why don’t you build a holiday fund? You still have a few months left, so start saving up for it. This way you can afford the trip without having to borrow, or at least borrowing too much.”, Arvind suggested.

“And anyway, we still have three months to plan for the trip. We can go to a less expensive destination instead!” Riya said.

“The sooner you start managing your money wisely; the lesser are your chances of getting into a debt trap. Loans should help you achieve your goals without becoming a cause of financial stress.” With this, Arvind left the three to plan their trip with a new perspective.

Go to Have too many borrowings? This quiz will tell you if you are in the Red. to see if you can differentiate between good and bad debts.

Related Topics

- Borrowing and credit basics

5 Ways to Protect Yourself from Financial Fraud

In today's digital age, financial fraud is becoming increasingly common. Scammers are constantly devising new ways to trick unsuspecting individuals into revealing their personal information or making fraudulent transactions.

- Borrowing and credit basics

6 Crucial Debt Management Tips to Learn & Apply In 2025

Are you struggling with managing your debt? You're not alone. Many people face challenges when it comes to debt management. However, with a few tips, you can learn to manage your debts effectively. In this blog post, we will discuss six important debt management tips that you can learn and apply in 2025.

- Borrowing and credit basics

Talk to the loan company for help

This is the last piece of the mantras series. In this piece, Arvind talks about the various ways your loan company can help in case of default. It suggests steps like contacting your lender asap and informing them about the reason for the delay, sharing your previous repayment history with them, etc. and informs you of the ways your loan company can help you deal with your debt. Then he informs Ravi about some ways his lender can help his deal with his debts.

- Borrowing and credit basics

Choose a systematic method to pay your debt

Arvind and Ravi are halfway through their 5 mantra plan and are meeting to discuss the third mantra - Adopt a method to pay debt systematically. Arvind helps Ravi chart out a workable method, which is best suited to his situation to pay off his debts.

- Borrowing and credit basics

Mantra 4 - Dig into your long-term savings to secure your today

You save money to secure your future, but your present may need it more at times. Particularly when dealing with excessive debt, savings and investments can help you repay them sooner. Find out how Arvind helped Ravi identify sources of extra money to clear his debts.

- Borrowing and credit basics

Mantra 2 - Find ways to make extra money

Have you ever found yourself struggling to manage your finances while repaying your debts? If yes, you may have to do more than just cutting down on unnecessary expenses. In this article, you will find how Arvind helped Ravi find extra money to pay off his debts.

- Borrowing and credit basics

Mantra 1 - Find money in your expenses

When you find yourself in a lot of debt, this first thing you should do is to reassess your budget. In this article, you will see how Ravi found money in his monthly expenses to repay some of his debts.

- Borrowing and credit basics

Is your debt controlling you? Read this to know

Debts can either help you achieve life goals sooner or pull you farther away from them. Ravi was struggling with his loans too, but Arvind told him about these 5 mantras that will help him get out of debt.

- Borrowing and credit basics

How much debt is too much

We all need to borrow money at some point in our lives. But it is very important to know when to stop and reassess our finances. This article mentions indicators that can tell you if you have more debt than you can comfortably repay.