How much debt is too much

Newlywed Sahu is a successful, intelligent young man, lovingly addressed as "Sahu Ji" even by the elders of the community. He strongly feels responsible for the improvement of his locality and is consulted on its important matters. But one day, when he told the local kiranawala to enter the bill amount in his “account”, he was asked to clear his old dues first. Sahu felt very angry, but he felt more insulted.

He never kept any dues for long; he paid them the next month if not in the same. Why this insult then?

The kiranawala even knew the reason for the delay of more than two months. It was because of all that expense for his wedding four months ago. Sahu owed his relatives money and will have to take a loan to clear off that debt. Moreover, only last month, he took a home loan and a cash loan of Rs 1,50,000/- too to furnish the new house. His wife liked a Samsung LED TV and a double-door refrigerator as well, which came with another loan worth Rs. 1,50,000.

The kiranawala should understand the stress of a newly married person. What was he thinking? That he would run away? The kiranawala was only adding to Sahu’s stress.

This sure smells like a debt trap, but the question is – could he have avoided it?

Arvind: Sahu’s case is not unique. People are always taking loans, either to buy things to have a better lifestyle or to meet a temporary cash shortage. Even paying with a credit card at a restaurant is basically udhari; you are eating on credit now but will pay later.

Nisha: But people take loans knowing fully well they must pay back – erm… someday.

Arvind: A loan itself is not bad. However, the practice becomes a problem when one cannot draw a line or say ‘STOP’ for certain expenses and go on taking loans. They purchase more than they should on credit and thus, their dues keep growing.

This brings us to the question: How much debt or udhari is too much?

Like some indicators tell us whether our blood pressure is high or low, there are ‘3 Debt Pressure Pointers’ that can help you keep your borrowings in check.

Debt Pressure Pointer 1 - What is too much in the eyes of your lender?

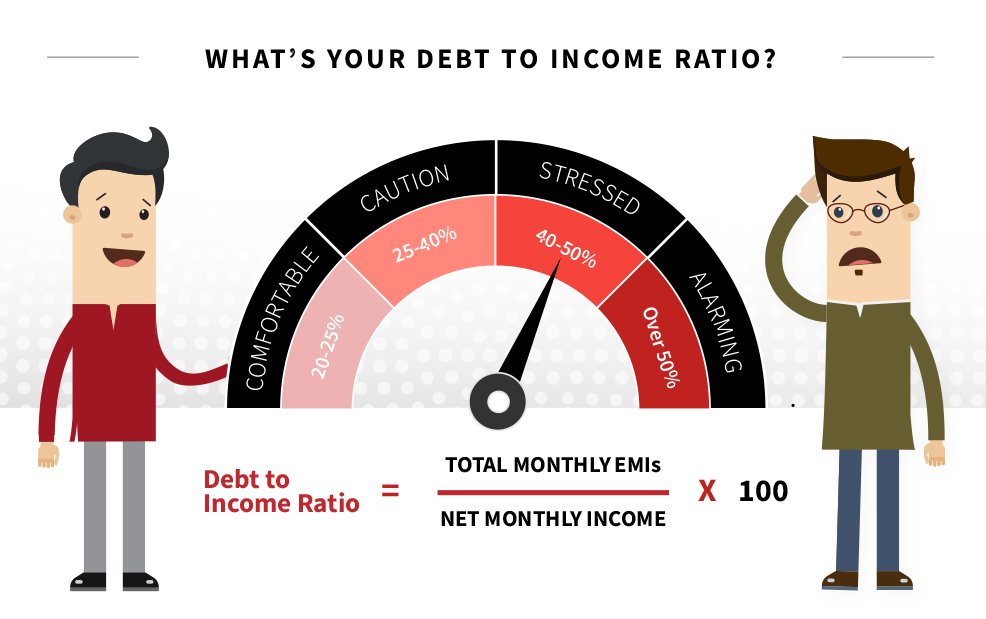

When you approach a bank or loan company, the loan manager will check your income as well as existing debts and repayment history, to calculate your Debt-to-Income (DTI) ratio. DTI helps you determine how much you can comfortably borrow based on your income.

- Udhari is called ‘debt’ or “loan” in English.

Lenders feel comfortable when your DTI is less than 40%. What this means is that when you add up all your monthly loan payments – credit card dues, house loan EMI, car loan EMI etc. – it should not be more than 40% of your income. So, if your monthly salary is Rs 30,000, your total monthly repayment towards these loans should not be more than Rs 12,000.

Sahu: But I keep getting calls for new loans. Can I take another loan to meet my ever-rising expenses?

Arvind: No, Sahu. Taking more loans when you are already struggling with the existing ones won’t be wise.

A software engineer like you working at an international company would earn well. I would advise you to reassess how you are managing your money instead.

Debt Pressure Pointer 2 - When your budget says it’s too much!

Another way to know if you have borrowed too much is to make a monthly budget and see if you can contribute towards these four broad goals:

· Saving towards a secured future- Fulfil aspirations and retire rich.

· Setting aside some amount every month to tackle emergencies - illnesses, car breakdown, sudden travel plans, job loss, etc.

· Paying monthly instalments on other loans comfortably.

· Managing your regular monthly expenses like food, clothing, utilities etc.

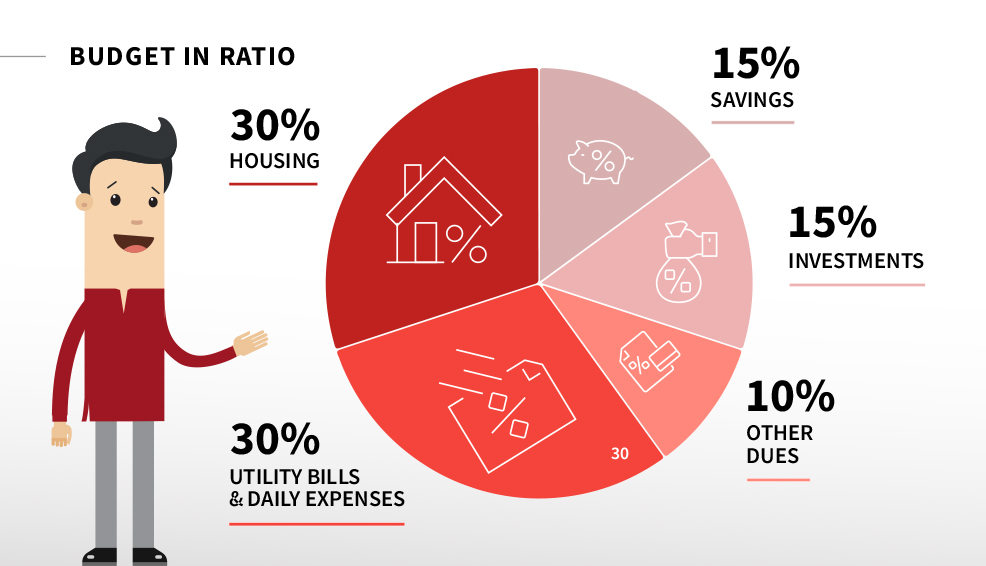

This is called the ’budgeting ratio’, which means you break down your take-home pay under different heads.

Please remember, the breakup below is just a suggestion. You can make allotments that are more suited to your personal needs. However, the following is a good starting point:

· 15% saved for long term goals or retirement corpus.

· 15% on short term investments and emergency fund.

· 30% (maximum) on housing. Ideally, this should be for home loan EMI as it means you are building an asset. If you are living in your own home, you can distribute this amount between saving for retirement corpus and investments.

· 10% on other dues (credit card, car/bike loan, etc.) Since the auto loan is fixed, you may have to adjust your credit card use.

· 30% on everything else, including utility bills like power and gas, and entertainment.

If you follow this general discipline, your life will have zero bad debts. If you ever feel that new debts will take your DTI past 40%, then stop right there!

Sahu: It all seems so difficult. But I need to bring about some financial discipline. By the time I’m halfway through a month, I don’t know where most of my money has gone.

Arvind: It is actually not so tough if you do it at the beginning of the month. Allocate money under different heads, as mentioned above, and make it a habit. After you have put money aside for savings, monthly expenses, and paid all your dues, you can spend the remaining amount on discretionary expenses.

Sahu: I just worry every day about making ends meet. I didn’t know getting married would be so stressful.

Arvind: You may not have realized, but that is an indicator of stress caused by debt, which is a part of the third pressure pointer.

Debt Pressure Pointer 3 - When the stress caused by debts says it’s too much

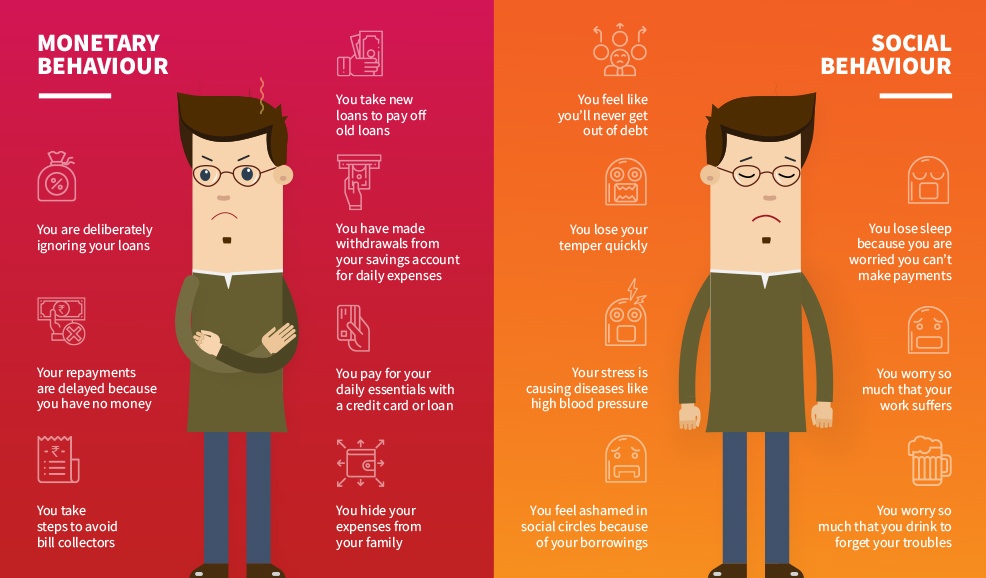

Not being able to pay on time brings behavioural changes and monetary challenges, which has a deep impact on one’s health and relationships. Following are some of the most common ones among people in debt.

Sahu, I've never seen you lose your cool before. But lately, you have been getting impatient about every small thing, and you don’t even smile often. If you observe more of these changes in yourself, it’s time to take steps to mend your relationships as much as your bad credit history.

You can start with these simple steps.

· Cut down spending on things you can do without for the next few months.

· Find ways to supplement your income. If your wife wishes so, she can start working too.

· Set aside a portion of your monthly income as savings for emergencies.

Keep your borrowings in check and whenever you see any of the above indicators, try to bring your DTI ratio down so that your finances don't get thrown off track.

Go to Do you know the right types of loans for you? to know how to make better borrowing decisions.

Related Topics

- Borrowing and credit basics

5 Ways to Protect Yourself from Financial Fraud

In today's digital age, financial fraud is becoming increasingly common. Scammers are constantly devising new ways to trick unsuspecting individuals into revealing their personal information or making fraudulent transactions.

- Borrowing and credit basics

Do you know the difference between good and bad debts!

This article will help readers differentiate between good and bad debts. It talks about the basic factors like cost, if the loan helps you build an asset, if it helps you secure your future, etc. that differentiate good debts from bad ones.

- Borrowing and credit basics

6 Crucial Debt Management Tips to Learn & Apply In 2025

Are you struggling with managing your debt? You're not alone. Many people face challenges when it comes to debt management. However, with a few tips, you can learn to manage your debts effectively. In this blog post, we will discuss six important debt management tips that you can learn and apply in 2025.

- Borrowing and credit basics

Talk to the loan company for help

This is the last piece of the mantras series. In this piece, Arvind talks about the various ways your loan company can help in case of default. It suggests steps like contacting your lender asap and informing them about the reason for the delay, sharing your previous repayment history with them, etc. and informs you of the ways your loan company can help you deal with your debt. Then he informs Ravi about some ways his lender can help his deal with his debts.

- Borrowing and credit basics

Choose a systematic method to pay your debt

Arvind and Ravi are halfway through their 5 mantra plan and are meeting to discuss the third mantra - Adopt a method to pay debt systematically. Arvind helps Ravi chart out a workable method, which is best suited to his situation to pay off his debts.

- Borrowing and credit basics

Mantra 4 - Dig into your long-term savings to secure your today

You save money to secure your future, but your present may need it more at times. Particularly when dealing with excessive debt, savings and investments can help you repay them sooner. Find out how Arvind helped Ravi identify sources of extra money to clear his debts.

- Borrowing and credit basics

Mantra 2 - Find ways to make extra money

Have you ever found yourself struggling to manage your finances while repaying your debts? If yes, you may have to do more than just cutting down on unnecessary expenses. In this article, you will find how Arvind helped Ravi find extra money to pay off his debts.

- Borrowing and credit basics

Mantra 1 - Find money in your expenses

When you find yourself in a lot of debt, this first thing you should do is to reassess your budget. In this article, you will see how Ravi found money in his monthly expenses to repay some of his debts.

- Borrowing and credit basics

Is your debt controlling you? Read this to know

Debts can either help you achieve life goals sooner or pull you farther away from them. Ravi was struggling with his loans too, but Arvind told him about these 5 mantras that will help him get out of debt.