Did you know credit scores affect your job prospects besides future borrowing!

Nisha’s brother, Gautam, was visiting them for the first time after he started working. He even brought gifts for everyone and wanted to take them out for dinner. Nisha was happy for him but thought this was the best opportunity to talk to him about how reckless he was being with his finances since he got his first credit card. He was just paying the minimum amount due for the last two months and has delayed payments a few times already. Nisha wanted Arvind to make him understand the effect this would have on his credit score and in turn, his future.

So, on the way to the restaurant, Arvind asked Gautam how his new job was going.

“It’s great. I enjoy it, and the best part is the financial freedom it gives me. I think in a year or two I’ll be able to buy a car too!” Gautam exclaimed.

“We’re so happy for you! Bas ab saving bhi shuru kar lo” Arvind suggested. “And remember, credit cards are very convenient, but you must clear the bills every month to avoid paying high interests. At the current rate of spending, your credit card will soon max out, and even your credit score will dip. Then, you won’t just find it difficult to get a new card but also an auto loan.

“But what does my credit score have to do with that?” Gautam was worried.

“Everything,” said Arvind. “When you apply for a loan, your credit score is one of the first things the lender checks to determine your eligibility. While a bad score can reduce your chances of getting a loan, a good credit score can even help you get it at lower interest rates.

Say, for example, you took a Rs. 50 lakh home loan at 8% interest for 15 years. By the end of the tenure, you will pay an interest of Rs 36 lakh. Even a minor bump of 1% on the interest rate due to an unfavourable credit score can increase your total liability by about Rs. 5.2 lakh!” Arvind explained.

“Really? I had no idea so many things depend on my credit score”, Gautam was surprised.

“Here are some ways your credit score can affect your borrowings:

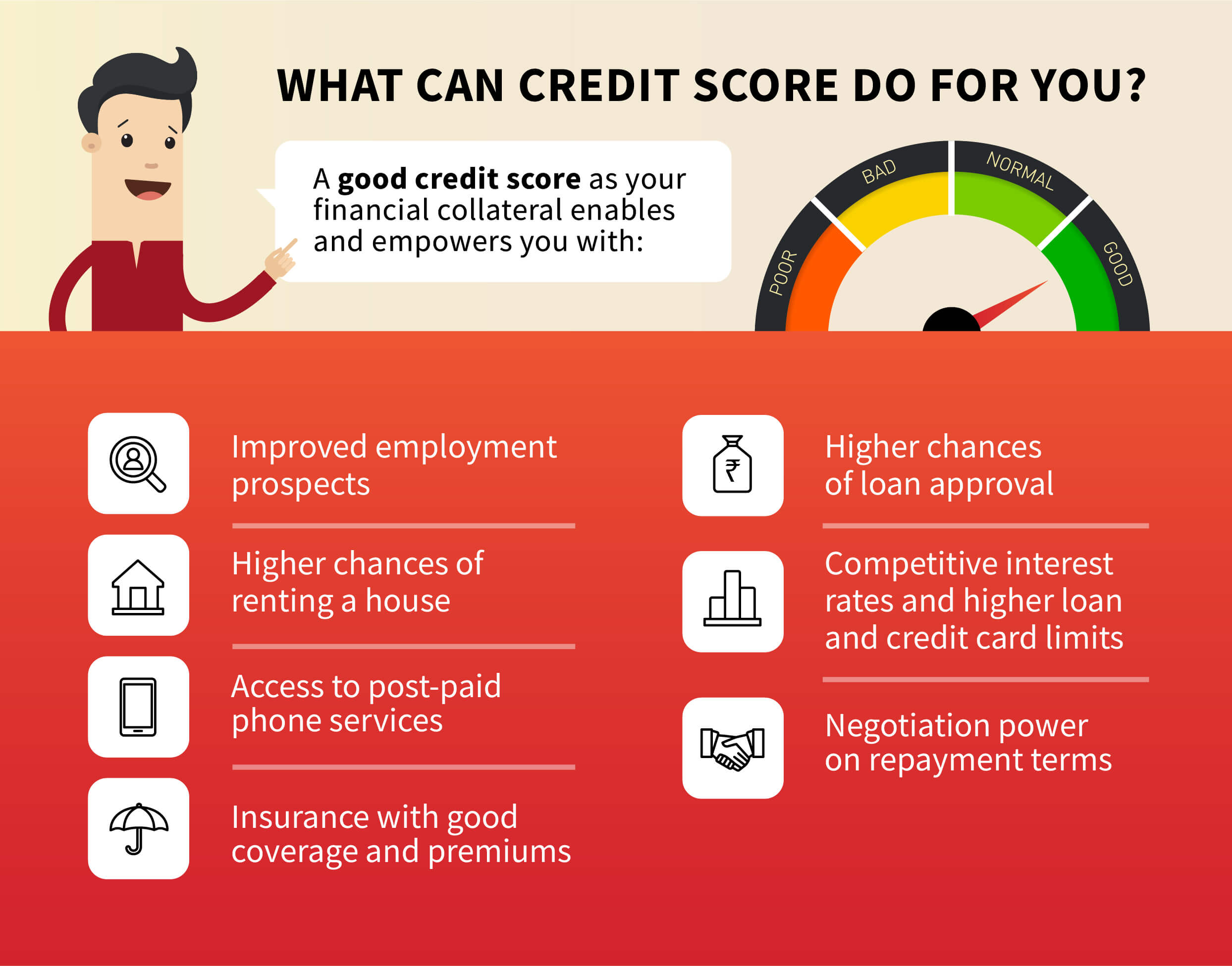

- Loan approval: A good credit score doesn’t guarantee loan approval, but it increases the chances as it assures the lender of timely repayments and lower chances of you defaulting. Similarly, a low credit score may not just cause delays but even rejection of a loan application.

- Interest rates: A good credit score gives you the power to bargain for a lower rate of interest because you would qualify as a low-risk customer. But someone with a low credit score is generally charged more interest to reduce the risk of losing money.

- Borrowing limits: Lenders are likely to approve more and larger loans if you have a good credit score as this shows you are responsible with money. While, it is not just harder to get loans, but you are less likely to get big-ticket loans with a low score.

You can also get great insurance deals with a good credit score.

- Repayment terms: A customer with a high credit score is revered and thus can negotiate on terms like tenure, fees and penalties, and instalment size. While someone with a low score will have to accept the given terms.

- Credit cards: If you have a good credit score, you can get credit cards with higher limits at lower rates with great benefits like rewards and cashback, unlike people with low credit scores, who may not get one at all. Making good use of credit cards can even increase your credit score.

- Housing: Nowadays some people take your credit score into consideration before renting out their property. Thus, a good score can help you rent an apartment of your choice.

“And lastly, this may shock you, but your future employment prospects also depend on your credit score. Employers these days aren’t just looking at your resume; they make a 360-degree assessment of potential employees. Some organisations now check your social as well as credit score to establish whether they can trust you or not,” Arvind informed Gautam.

Gautam got worried when he heard this, thinking about his future. Arvind noticed and spoke with a smile, “You are young, and if you start being responsible with your money and repayments, you can build a good credit score which will help you get a good deal on that car you’ve been hoping to buy!”

With this, they finished their dinner and Nisha sighed with relief.

Read How to improve a damaged credit score? to know effective tips to raise your credit score.

Related Topics

- Managing Debts

Making the Right Financial Decisions Through Financial Literacy

In a world driven by constant change and economic uncertainties, the ability to make informed financial decisions is more crucial than ever.

- Managing Debts

How To Keep Yourself Safe From Online KYC Scams?

In an era dominated by digital interactions, the convenience of online services comes with an inherent risk

- Managing Debts

Why 77% of Working Professionals Rely on Personal Loans?

In today's fast-paced world, managing finances can be a daunting task for working professionals.

- Managing Debts

How to Choose Your Ideal Repayment Tenure for Personal Loans?

Personal loans have become an indispensable financial tool for many individuals, offering a quick and convenient way to address various financial needs.

- Managing Debts

Top 10 Ways to Identify Personal Loan Scams Online

In a world driven by digital advancements, online personal loans have become increasingly popular in India.

- Managing Debts

What is Repo Rate? How Does it Affect the Economy?

Have you ever heard the term "repo rate" and wondered what it's all about? Well, you're not alone.

- Managing Debts

What is Debt to Income Ratio and How is it Calculated?

Managing your finances wisely is essential for a secure financial future. One crucial aspect of financial health that often gets overlooked is the Debt-to-Income Ratio (DTI).

- Managing Debts

Things to Tell Your Child When They Apply for Their First Personal Loan

As your child ventures into adulthood, they will face various financial milestones, one of which may be applying for their first personal loan.

- Managing Debts

How Can a Personal Loan Be Used as an Investment?

In today's fast-paced world, financial goals and dreams are many. Whether it's pursuing higher education, starting a small business, or renovating your home, we all have aspirations that require financial support.

- Managing Debts

5 Smart Tips For Easy Personal Loan Management

In today's world, personal loans have become an important financial tool to help individuals meet their financial goals. Be it organizing a wedding, buying a car or house, or even consolidating debt, personal loans can provide much-needed financial help.

- Managing Debts

Things you should always check while borrowing money

Interest rate is what a loan company or bank charges for the loan amount they grant you. It is an important factor that determines the total cost of the loan.

- Managing Debts

Could your decision to take another loan make you regret later!

Have you ever made an impulsive purchase and regretted later? Or fell into the trap of a promotional offer? This article tells you the important questions that you must ask before deciding to borrow money for anything.

- Managing Debts

Do you have everything you need to apply for a loan!

Are you planning to take a loan soon? But are you fully prepared to take the loan? Here’s a checklist you must read to make sure your loan application is processed and approved easily.

- Managing Debts

What is a budget? Why is it so important!

Budgeting is the solution of most financial problems. In this listicle, learn about what budgeting is and its many benefits.

- Managing Debts

Heard of paying yourself first? – Here is why it is important

Paying yourself first ensures you always save money. Read on to understand more about what it is and how it can help you.